The global effort to limit the spread of COVID-19 has had a profound effect on the world economy. Credit risks associated with the COVID-19 pandemic are yet to be fully understood.

To support the industry in understanding the impact of these events on credit risk profiles, GCD has developed a COVID-19 Crisis Benchmarking Platform.

Objective:

To help banks’ credit risk teams understand how the risk profiles of critical industries and obligors are being impacted by the COVID-19 pandemic, on an ongoing basis.

How to participate:

- Contact Hale Tatar to register

- Submit monthly updates of risk estimates (both PD and LGD) for named obligors. GCD’s data template is easy to use and ensures complete data security, quality and anonymity.

What you get in return:

Participating banks will receive confidential, high-quality, granular and anonymous output data with a strong validation process that will allow them to:

- Directly benchmark risk estimates (PD, LGD, and CCF) on specific names with peers

- Follow changes in risk estimates over time

If you are interested in learning more, contact Hale Tatar.

Just in! Initial results from our COVID-19 Crisis Benchmarking Platform are now available

Participating banks receive exclusive access to granular and high-quality data across geographies and asset classes.

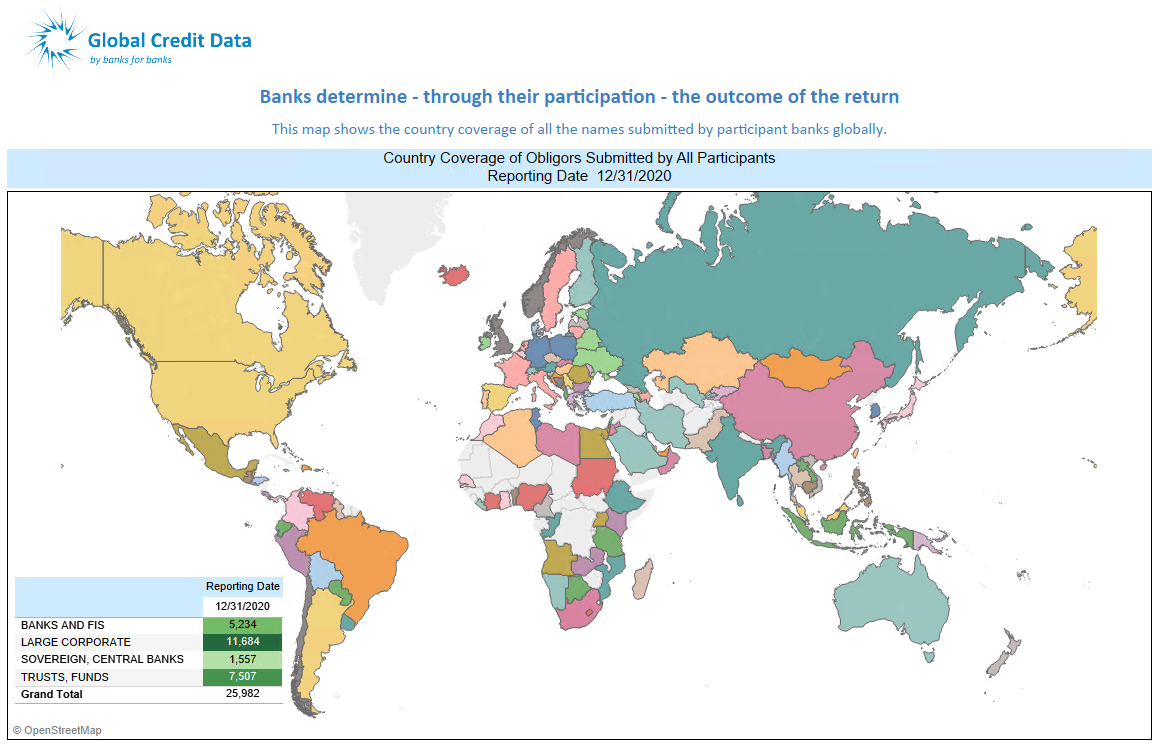

A broad geographical spread: Obligor names submitted by participant banks span over 70+ countries.

Deep insights into a comprehensive set of obligors: Over 25,000 obligors across Large corporates, Sovereign & Central Banks and Banks and Financial insututions.