Services: Benchmarking

Global Credit Data collects raw data from its members and distributes it back to them for use in their own analysis and modelling. GCD supports its members by providing a flexible high-end tool on the data pool: the GCD Visual Analyzer. Member banks can create dynamic Reference Data Sets and generate instant views on the data.

Obligor Level Benchmarking

What we do

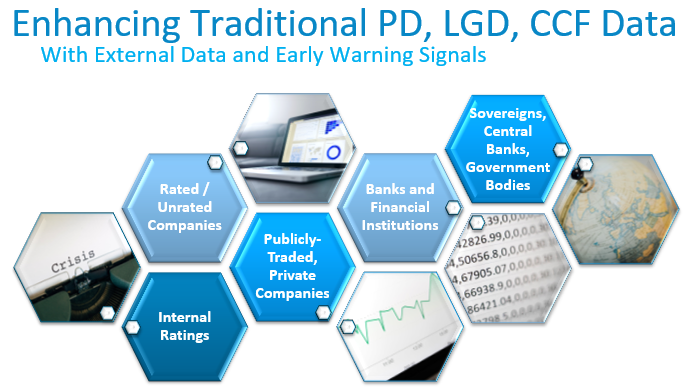

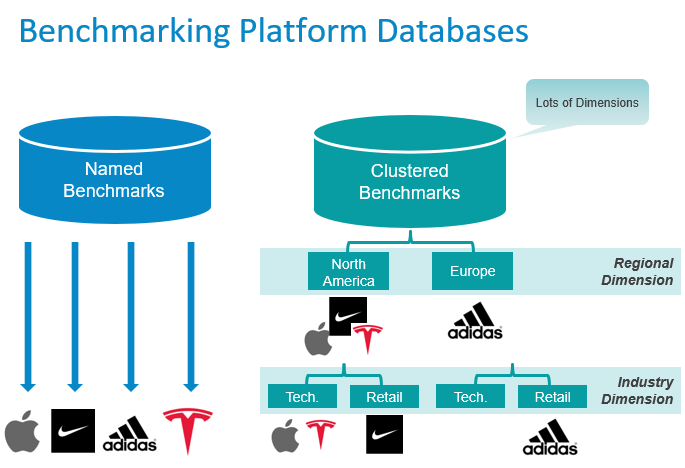

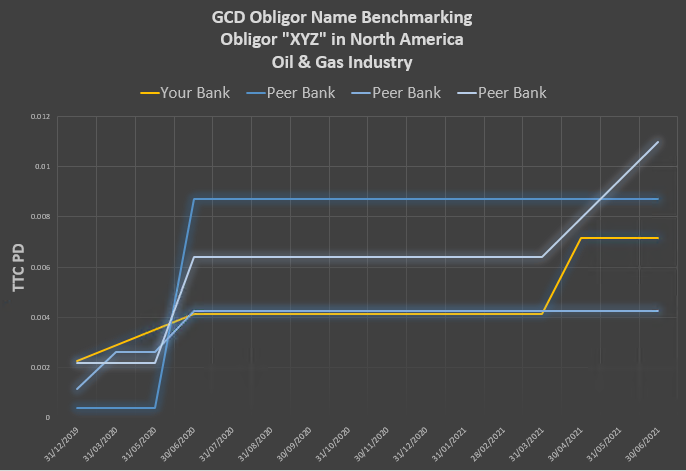

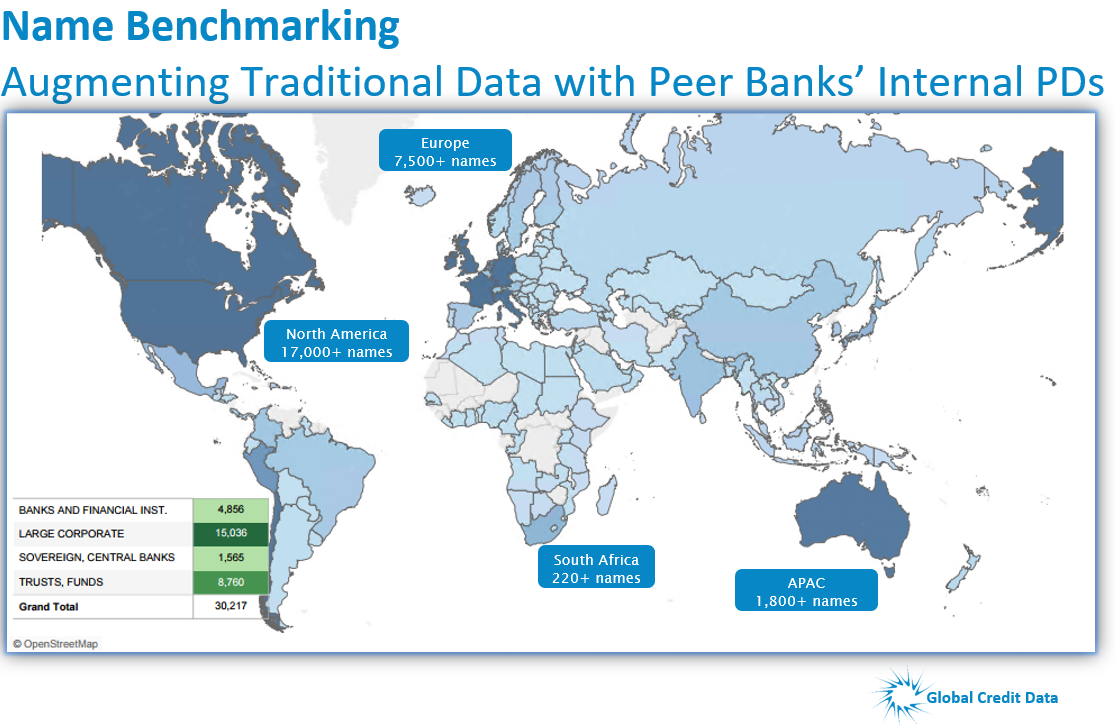

GCD benchmarking platform allows our members to benchmark the rating and loss estimates of their clients with those of their peers banks. Data exchange of the PD and LGD estimates on a name basis is performed in an anonymized way and treated with absolute confidentiality.

GCD has set up this service recently based on the wish of its member banks who have trusted GCD since years with their data handling and data security. The service offers data for more than 5000 clients worldwide as well as average PD and LGD levels for pre-defined clusters.

How can the database be embedded in your regular banking processes

- Directly benchmark your risk estimates (PD, LGD, EaD) on specific names and detailed risk clusters with your peers

- Follow changes in risk estimates over time

- Feedback the information in your model development and calibration processes

For members (login first)

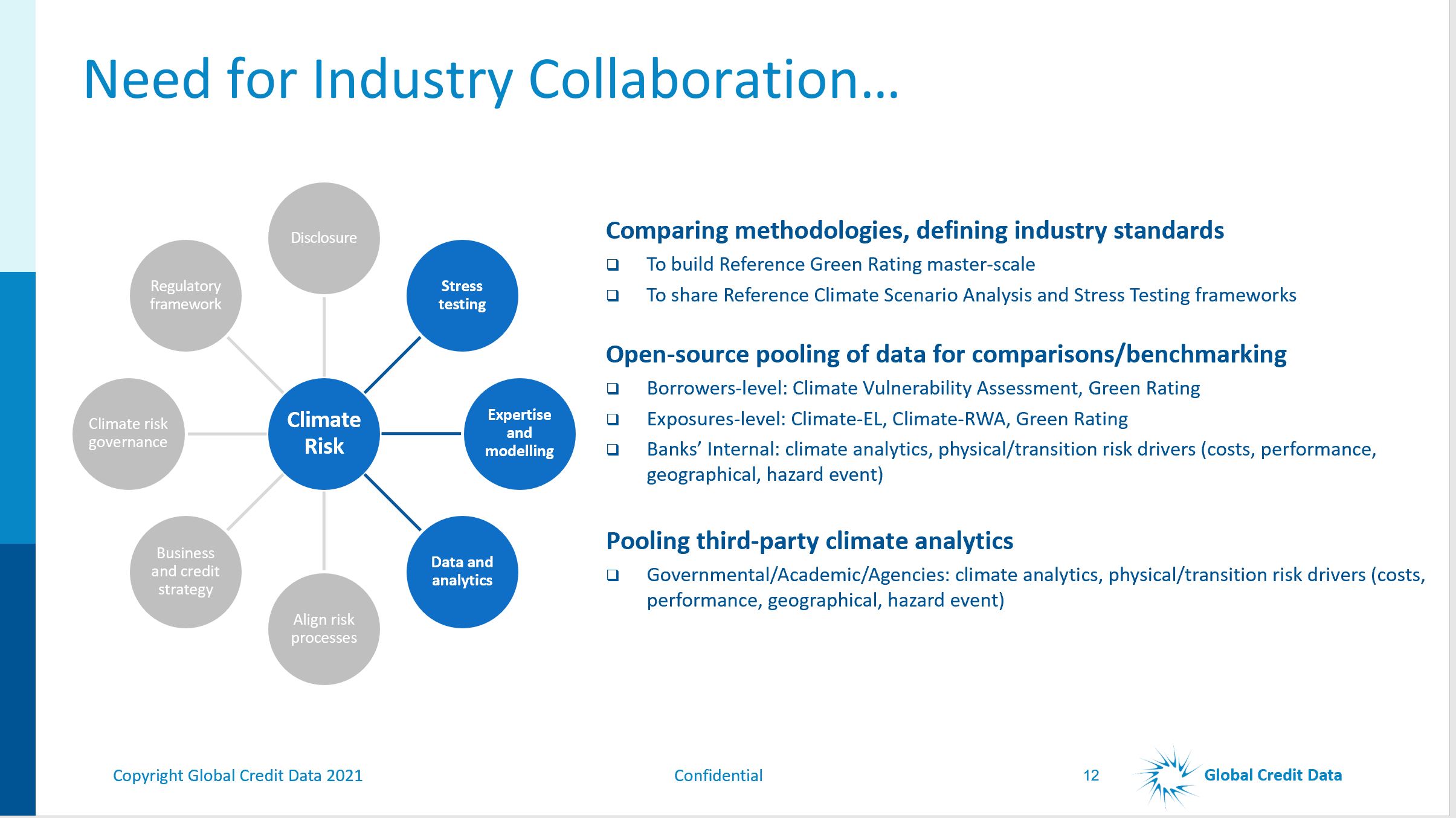

Climate Risk

In various publications, regulators and financial industry associations stressed the importance of Industry Collaboration in the field of Climate Risk. GCD - a non-profit credit-data-sharing service to which your Bank already contributes - is contemplating the opportunity to cover climate risk analytics. Please join the forthcoming webinars to express expectations and define the benefits of Climate Risk Data Sharing for your institution.

At the GCD North American Conference, hosted in October 2021, the collaboration with the IIF was evident and together GCD and the IIF are working on being the solution banks need.

Expected Credit Loss Benchmarking

(IFRS 9 and CECL)

IFRS 9 Benchmarking Study

- Variability of ECL estimates is noticeable for all asset classes

- The variability between banks’ estimates is observed for all segments defined by ECL drivers such as obligor type, geography, industry, rating and PD, facility type, guarantees and collateralization

- Bank-specific or reference macro-economic scenarios used for projections led to identical conclusions: in the current macro-economic environment, the variability between banks is mainly caused by banks’ different models and not by different macro-economic forecasts

- In order to “measure” the variability, we introduce a multiplier (=ECL 3rd quartile / ECL 1st quartile, calculated over all participating banks). We see that the multiplier is fairly stable over all asset classes and – on average – stands at least at a level of 4.

- Projections of stress test scenarios logically increase ECL levels and also notably increase the variability between banks

- Determine how your bank's IFRS 9 estimates compare to that of peer banks.

- Neutral to your bank's portfolio or macro-economic forecast

- Be able to track down the reason for the variability, e.g.

- Does the difference lie in the PD estimation, the LGD estimation or the exposure calculation?

- How much is the 12-month ECL or the lifetime ECL impacted by banks' economic forecast?

- Is your bank's stage allocation process more or less conservative than that of other banks?

- Do banks PD curves differ by country? How many banks apply LGD term structures?

- In which countries is the variability between banks the most?

- How does the expected life of revolving facilities differ between banks?

- "By banks, for banks": We value your input in changing the study to your needs

- Aligned with GCD's other data pools: Easily explain further differences making use of GCD's

- Benchmarking platform: Benchmarking estimated PD, LGD and CCFs on name-by-name basis / by “risk cluster”

- Ratings and PD platform: Benchmarking observed default rates by “risk cluster”

- LGD/EAD platform: Benchmarking observed LGDs and CCFs

- Based on GCD's data pooling infrastructure: Highly-secured data portal and data pooling regulations ensure maximum confidentiality

- Ultimately, strengthen your IFRS 9 model development and validation process

Benchmarking CECL models

CECL will have the most significant impact on American banking since the Dodd-Frank Act was adopted. Models currently being developed indicate that bank profitability—and bank department profitability—will be affected as institutions charge for credit loss provisions on new loans and credit downgrades on existing loans.

GCD is working with Accenture and the IIF to help U.S. financial institutions benchmark their CECL models as they are developed.

Step 1 was a deep CECL Methodology survey sponsored by Global Credit Data, the IIF and Accenture. The survey provided comparative information on bank’s planned methodologies for implementation of CECL. The questions focused on credit data and modeling for the C&I, CRE and Consumer portfolios. A public version of the survey results is available here.

Step 2 was a benchmarking study among major US Banks. A public version of the results is available here.

For more information, listen into the webinar below, download the material here

In Cooperation with:

NOTE FOR MODELLERS:

GCD has the world largest database collecting data related to credit failures (default) and their recoveries. The data dates back to 1998, allowing for meaningful statistics in terms of type of borrower, time and size of exposure at default and collateral recovery rates.

Check our LGD & EAD platform for more information.

GCD COVID-19 Crisis Benchmarking Platform

The global effort to limit the spread of COVID-19 has had a profound effect on the world economy. Credit risks associated with the COVID-19 pandemic are yet to be fully understood.

To support the industry in understanding the impact of these events on credit risk profiles, GCD has developed a COVID-19 Crisis Benchmarking Platform.

Objective:

To help banks' credit risk teams understand how the risk profiles of critical industries and obligors are being impacted by the COVID-19 pandemic, on an ongoing basis.

How to participate:

- Contact Hale Tatar to register

- Submit monthly updates of risk estimates (both PD and LGD) for named obligors. GCD's data template is easy to use and ensures complete data security, quality and anonymity.

What you get in return:

Participating banks will receive confidential, high-quality, granular and anonymous output data with a strong validation process that will allow them to:

- Directly benchmark risk estimates (PD, LGD, and CCF) on specific names with peers

- Follow changes in risk estimates over time

If you are interested in learning more, contact Hale Tatar.

Just in! Initial results from our COVID-19 Crisis Benchmarking Platform are now available

Participating banks receive exclusive access to granular and high-quality data across geographies and asset classes.

A broad geographical spread: Obligor names submitted by participant banks span over 70+ countries.

Deep insights into a comprehensive set of obligors: Over 25,000 obligors across Large corporates, Sovereign & Central Banks and Banks and Financial institutions.

Working Groups, Surveys & Other Benchmarking Activities

Given the maturity of models for credit risk at many of our member banks, Global Credit Data has in recent years focussed more on studies, surveys and working group activities intended to allow members to benchmark their credit risk models and drivers.

On our own and in conjunction with financial industry bodies, Global Credit data conducts surveys and performs comparisons and analyses to help members better understand their own methods and estimates.

Members' needs for discussion of best practice in data, modelling and risk measurement is well served by ad hoc working groups. Often the key benefit of these groups is the discussion and cross information about best practices, while some will also produce an output paper.

Recently completed working groups covered the topics of:

- Stresstesting and CCAR modelling (Framework, Processes, Modelling techniques)

- Modelling LGD for Commercial Real Estate

- Modelling LGD for Project Finance

- Modelling Downturn LGD

- Discount Rate in LGD modelling

- Segmentation of LGD models

- Trade & Commodity Finance

- Banks and Counterparties in Financial Markets

The following working groups are at the moment active within Global Credit Data. For some working groups non member participation is allowed. Please consult Global Credit Data using the contact form should you be interested.

| IFRS 9 / CECL impairment models |

| This working group enables knowledge exchange & discussions on modelling approaches for impairments based on (life-time) expected losses. The most recent activity was to initiate a benchmarking study where banks compared their ECL estimates, PDs and LGDs for various hypothetical borrowers under different scenarios |

| Chair: tbc Contact: Hale Tatar, Executive |

| Validation |

| This working group enables knowledge exchange & discussions on validation techniques, processes and policies. |

| Chair: tbc Contact: Nina Brumma, Executive |

| LGD Reference Model |

| This working group supports the development of a LGD Reference Model. |

|

Chair: Stephan Jortzik (ANZ), Michael Jacobs (PNC), Patrik Gunnarson (SEB) Supported by: FCG Contact: Olivier Plaetevoet, Executive |

| Support for Compliance |

| This working group defines actions to support members in demonstrating the compliance of using GCD data with most recent regulations. |

| Chair: tbc Contact: Olivier Plaetevoet, Executive |

Members only: Login to access our FAQ's on working groups and focus groups.

Industry Contributions

GCD uses its unique data and methodology knowledge to provide independent factual analyses of credit risk in the finance industry.

Global Credit Data works jointly with industry groups such as The Institute of International Finance (IIF), International Chamber of Commerce (ICC) and The Association for Financial Markets in Europe (AFME) to help its member banks discuss regulatory topics with regulators and management. At the request of its members, GCD has also been involved in direct discussions with the Risk Measurement Group (RMG) of the Basel Committee to explain how much data the industry has.

Below some examples of public documents where GCD's data is cited.

Note: GCD does only provide the factual data and is not the author of these papers. Any views expressed in these presentations are those of the author and do not necessarily represent the views of Global Credit Data or its members.

| Organisation | Category | Topic |

|---|---|---|

| AFME | Shipping Finance | Object finance: The characteristics of shipping finance |

| Commodity Finance | Capital treatment of commodity finance | |

| Downturn LGD | Discussion paper on downturn LGD | |

| IIF | Downturn LGD | IIF Comments on Economic Downturn, and EBA GL on Downturn LGD |

| EACB | RWA variation | Response to BCBS consultation on reducing variation in credit risk-weighted assets |

| GFMA, ISDA, IACPM, JFMC | RWA variation | Response to BCBS consultation on reducing variation in credit risk-weighted assets |

| FBA | RWA variation | Response to BCBS consultation on reducing variation in credit risk-weighted assets |

| AWG | RWA variation / Aircraft Finance |

Response to BCBS consultation on reducing variation in credit risk-weighted assets |

Additional work relates to the revised standardised approach impact analysis (with IIF), LGD/LGL papers, commodities analytics (AMFE), Trade finance (with ICC) and a point in time vs through the cycle analysis (IIF).

All non-public industry contributions are stored in our library (login for members required to get access to the full content).