Access LGD Data Here

Access LGD Data Here

Press Release:

US CRE Recovery Rate Report!

GCD and UNEP FI Partnership

Events:

GCD Frankfurt Conference 2025

Provides risk insights directly from anonymized internal data of member banks and promotes knowledge sharing within the financial industry.

The long time series of historical credit losses allow banks to model loans’ recovery processes. GCD provides also credit rankings and obligor internal rating transition data for all key bank portfolios.

Data Pooling : PD & LGD

GCD is a unique data consortium that collects banks’ internal data for both PD and LGD. GCD’s data pools support the key parameters of banks’ credit risk modelling: Probability of Default (PD), Loss Given Default (LGD), Exposure at Default (EAD).

Library: Research & Publications

GCD’s library gives access to a wide variety of publications on risk-related topics. GCD members work together to analyze data and discuss methodology issues.

GCD is actively promoting academic research on the data collected.

Data Insights & Reports

Discover the latest insights on credit risk with GCD's published reports, offering valuable industry analysis and benchmarks.

Services: Benchmarking

Global Credit Data collects raw data from its members and distributes it back to them for use in their own analysis and modelling.

Member banks can create dynamic Reference Data Sets and generate instant views on the data.

Services: ESG and Climate Risk

Global Credit Data members have a collaborative platform to exchange data and knowledge with their peers on how to incorporate climate and environmental factors into credit risk modeling through industry-wide best practices

Latest Insights

GCD Model Tiering Survey Results Released

Detailed survey on how banks classify models for model risk management purposes. These insights highlight the critical role of model tiering in enhancing risk management practices across the banking sector.

Climate Risk Benchmarking Survey by GCD and UNEP FI – Registration Now Open!

Survey to advance the methodologies and benchmarks used by financial institutions to assess and manage climate risks.

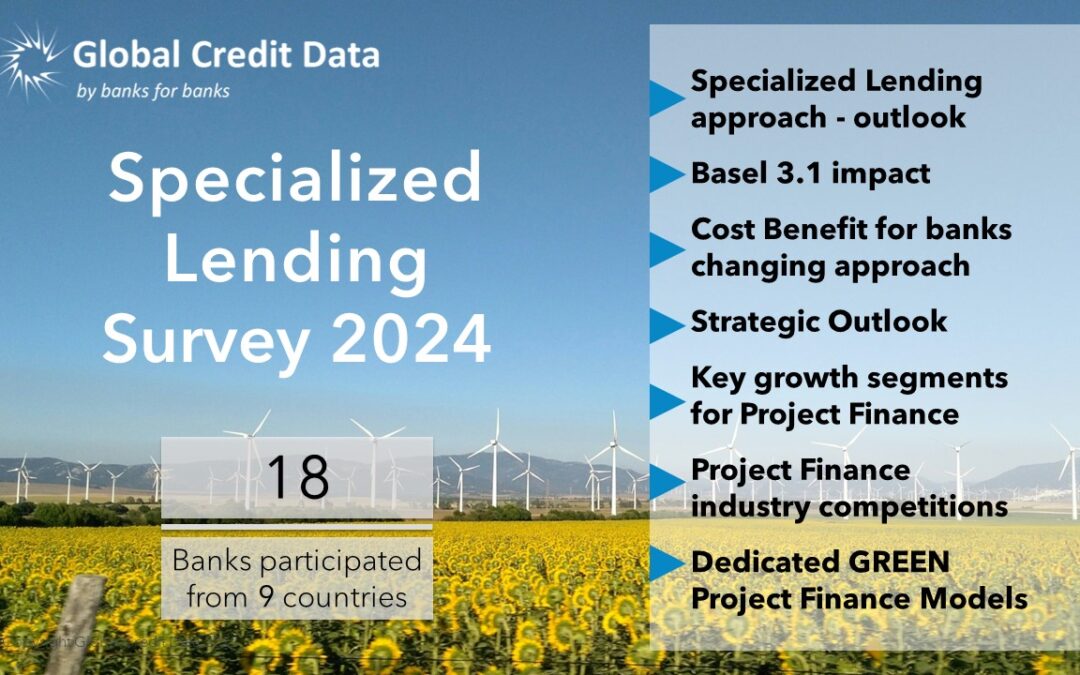

GCD Specialized Lending Survey 2024

Detailed overview of how banks are preparing for the future of Specialized Lending. It covers regulatory actions, portfolio development, and strategic approaches.

Pandemic Aftermath: GCD Data Reveals Decline in US Real Estate Recovery Rates

New Report Highlights Impact of COVID-19 on U.S. Commercial Real Estate

2024 H1 Cycle Data returns released on GCD Platforms!

GCD Platforms Release Comprehensive H1 Cycle Data Returns The latest data returns for the H1 cycles have been released on all GCD platforms. This release provides banks with the most current and comprehensive data for Probability of Default (PD) and Loss Given Default (LGD) modeling, benchmarking, and more! We extend

News: GCD and UNEP FI Collaboration

GCD and UNEP FI Collaborate to Enhance ESG and Climate Risk Efforts Global Credit Data (GCD) and the United Nations Environment Programme Finance Initiative (UNEP FI) are pleased to announce their partnership. This partnership aims to advance the methodologies and benchmarks used by financial institutions to assess and manage climate risks.

Academics

Global Credit Data is proud to support academic research to further the study of finance.

Events

GCD hosts events throughout the year for members and industry leaders on topics that benefit banks.

GCD Newswire

GCD actively publishes reports and studies about how data will impact different industries.

GCD Data User Guide

Data quality is key to GCD and the extensive documentation forms an integral part of GCD's data quality approach.