Meet the GCD Board

Global Credit Data is governed by a Board, whose detailed responsibilities are defined in the Articles of Association. The members of the Board are individuals appointed by the Global Credit Data General Assembly among the delegates representing the Members.

Click here for more information on GCD Operations.

Simon Ross-Hansen

Chairperson of the Board

Simon Ross Hansen

Board member (since December 2010)

Mr. Simon Ross-Hansen is presently heading the credit modelling unit at Nykredit. His career credentials include leadership roles in Nordea and Danske Bank heading different credit modelling units, portfolio management as well as bank's risk control unit. Before joining Danske Bank he was a consultant both in and outside the financial sector.

Mr. Ross-Hansen holds a Master's degree from the Danish Technical University, as well as a Bachelor's in Finance from the Copenhagen Business School. He lives in Greater Copenhagen.

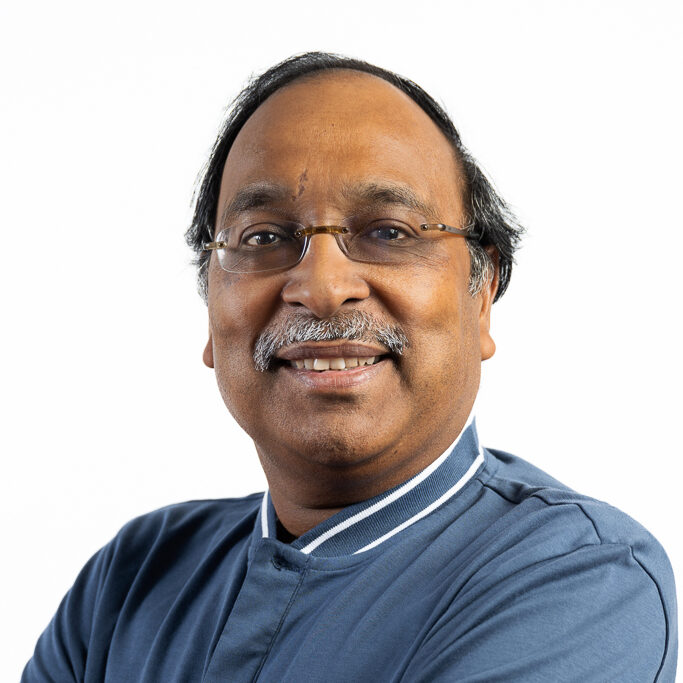

Sanjay Gupta

Deputy Chairman

Sanjay Gupta

Board member (since December 2016)

Deputy Chairman

Sanjay Gupta is Executive Vice President and Head of Model Development at PNC Bank. He is responsible for the development of most of the quantitative models for Basel II, CCAR, Acquisition Scorecards, Operational Risk and Economic Profit for Wholesale and Retail Assets for PNC. He has been involved with Global Credit Data since 2016.

Massimo Cutaia

Board Member, Treasurer

Dr. Massimo Cutaia

Board member / Treasurer (since June 2016)

Stephan Jortzik

Board member, Chairman of the Methodology Committee

Stephan Jortzik

Board member (since June 2016)

Chairman of the Methodology Committee

Stephan Jortzik brings along more than 15 years of experience in capital markets research and the financial industry. He contributed extensively in developing advanced quantitative methods for identifying and measuring portfolio risks and building models for single name and portfolio risk estimates, both academically and applied practically, covering areas in credit and operational risk. He specialises in PD, LGD, EAD modelling, forecasting and stress testing.

Dr. Jortzik is currently Head of Wholesale Credit Risk Modelling at the Australia and New Zealand Banking Group (ANZ), responsible for IRB wholesale credit models globally. Before joining ANZ, he held positions at Westpac and Fitch Ratings.Dr Jortzik graduated and holds a PhD in Economic Sciences from the University of Goettingen.

Maz Khan

Board Member

A senior Managing Director with a passion and proven track record to drive and deliver key strategic outcomes for global investment banking businesses. Over 25 years of professional experience in the industry, with first-hand expertise in developing and implementing transformation strategies across many aspects of the end-to-end business.

From a solid foundation built in IT, he has continued to apply the structured approach to solving complex business problems as a front office COO and business change leader. These include setting up derivatives trading desks, supporting private equity investments, integration of businesses following acquisition, divestment of businesses, setting up of supervisory and financial crime risk and control frameworks and leading cultural change to address conduct, and behavioural shortcomings in the front office.

Jean-Gabriel Albigot

Board Member

Jean-Gabriel Albigot

Jean-Gabriel Board member (since June 2016)

Jean-Gabriel is in charge of the coordination of credit risk modeling throughout Société Générale. He started his career as a quantitative credit risk analyst in 1998, focusing on the development of regulatory and economic capital models. He then spent 6 years as a structurer in the reinsurance industry, and in the Corporate and Investment Banking arm of Société Générale to develop ALM, risk management and capital management solutions customized to the needs of large financial institutions. By the end of 2008 he was appointed head of the financial engineering team of the French Retail banking arm of Société Générale, managing the liquidity position of the entity and working on the optimization of the product range. In May 2013 he moved to SG Risk management division, within the Risk Modelling Function.

He also chairs the Risk Weighted Assets group of AFME’s prudential regulation division (Association for Financial Markets in Europe - http://afme.eu/Divisions/Prudential-Regulation/).

Jean-Gabriel holds an MBA from the French ESSEC Business School and is a fellow of the French Institute of Actuaries. Jean-Gabriel holds an MBA from the French ESSEC Business School and is a fellow of the French Institute of Actuaries.

Mark Dutrisac

Board Member

Mark Dutrisac

Board member (since June 2023)

Mark Dutrisac is Vice President Credit analytics & Climate risk at National Bank of Canada.

At National Bank of Canada since 2004, Mark has held several analytic roles in credit risk. Since December 2021, he serves as Vice President Credit Analytics and Climate Risks. As part of his mandate, he is responsible for AIRB models, IFRS9 models and provisions, stress testing, governance of credit decision models and strategies, credit risk management and disclosure of the Bank's Retail, Commercial and Corporate portfolios, as well as development of credit climate risks analytic capabilities.

Recognized for his rigor and critical thinking, he has acquired, over the years, an in-depth knowledge of data environments, modeling methodologies, an ability to develop diverse and high-performance teams, as well as a pragmatic approach focused on execution and a clear vision of complex environments. Mark holds a bachelor's degree in mathematics and a master's degree in statistics, specializing in data exploration from the University of Sherbrooke. Prior to joining National Bank of Canada, Mark worked a few years as a statistician in the Telecom and Pharmaceutical industries.