All the Latest GCD News

Below is the collection of all the latest GCD news, posts, and highlights. Make sure you visit the secure working group pages for posts relating to them.

GCD Specialized Lending Survey 2024

Detailed overview of how banks are preparing for the future of Specialized Lending. It covers regulatory actions, portfolio development, and strategic approaches.

Climate Risk Benchmarking Survey by GCD and UNEP FI – Registration Now Open!

Survey to advance the methodologies and benchmarks used by financial institutions to assess and manage climate risks.

Pandemic Aftermath: GCD Data Reveals Decline in US Real Estate Recovery Rates

New Report Highlights Impact of COVID-19 on U.S. Commercial Real Estate

2024 H1 Cycle Data returns released on GCD Platforms!

GCD Platforms Release Comprehensive H1 Cycle Data Returns The latest data returns for the H1 cycles have been released on all GCD platforms. This release provides banks with the most current and comprehensive data for Probability of Default (PD) and Loss Given Default (LGD) modeling, benchmarking, and more! We extend

News: GCD and UNEP FI Collaboration

GCD and UNEP FI Collaborate to Enhance ESG and Climate Risk Efforts Global Credit Data (GCD) and the United Nations Environment Programme Finance Initiative (UNEP FI) are pleased to announce their partnership. This partnership aims to advance the methodologies and benchmarks used by financial institutions to assess and manage climate risks.

Press Release: The Global Credit Data Consortium appoints Ramadurai Krishnan as CEO

The Global Credit Data Consortium appoints Ramadurai Krishnan as CEO.

GCD Toronto Spring Conference 2024 Highlights

GCD Toronto Conference 2024 - Credit Risk | ESG | Climate

Climate Focus Group Update March 2024: Climate Stress Testing, Global Events & Regulatory News and more

Author Hale Tatar View all posts

Register now! GCD Toronto Conference 2024 | April 29th

Register Now for Toronto Conference Spring 2024

Announcing the Latest Data Release!

With over 30,000 names spanning across North America, Europe, South Africa, and Australia, banks utilize our Name Benchmarking data pool as a valuable resource for comparing risk parameters with their counterparts in similar regions.

GCD Recovery Rate for Loans with Insurance Guarantors

Global Credit Data and ICC and ITFA Collaboration: Recovery Rate for Loans with Insurance Guarantors

GCD and ICC – 2023 Trade Register Report

In partnership with Global Credit Data, ICC have released the 2023 ICC Trade Register Report.

Impressions from the GCD Amsterdam Conference

Here are some snapshots that capture the essence of the Amsterdam Conference 2023.

GCD Representativeness Focus Group – Join Today!

Join the GCD Climate Risk Focus Group (CRFG) to help shape our approach to climate-related credit risks and become part of a collaborative and knowledge-sharing community for climate experts.

GCD Climate Risk Focus Group – Join Today!

Join the GCD Climate Risk Focus Group (CRFG) to help shape our approach to climate-related credit risks and become part of a collaborative and knowledge-sharing community for climate experts.

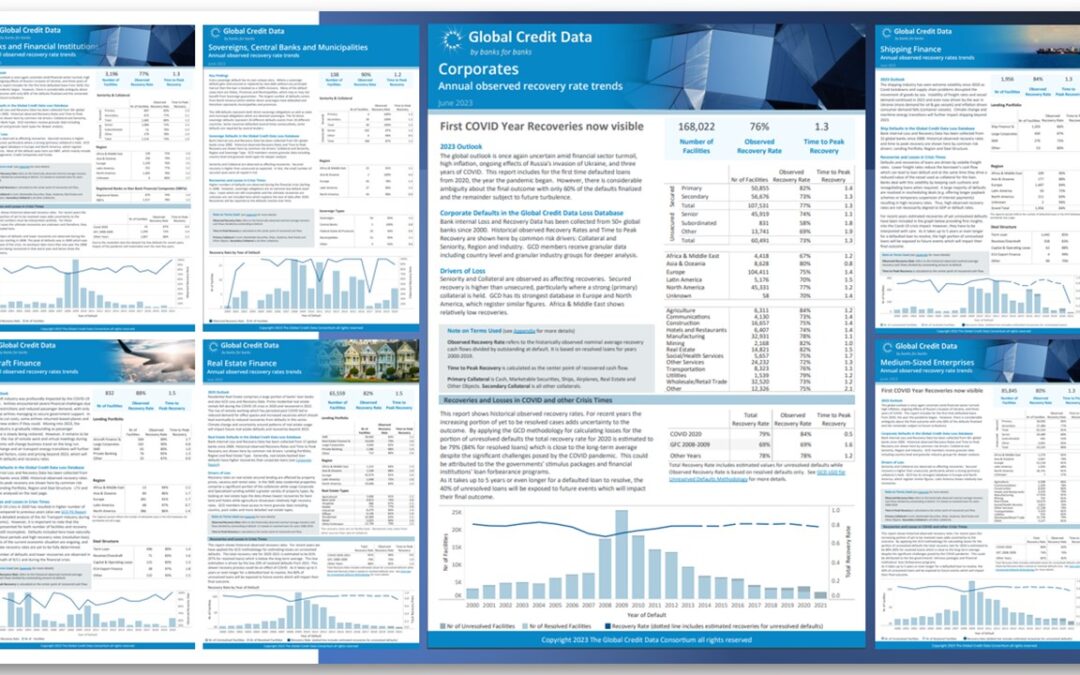

GCD Recovery Rate Reports published!

Global Credit Data's yearly Recovery Rate Reports for Corporates, Banks, Sovereign, Aircraft, Shipping, and Real Estate defaults provide instant insight into observed recovery levels and other key benchmarks for various exposure classes, industry sectors, and collateral types.

GCD Data Quality Dashboard 2023 – available

Since 2004, GCD has continuously reinforced a framework that is used to measure and monitor Data Quality (DQ). The objective is to achieve high DQ and compliance for the GCD pooled data, as required by global regulations (BCBS 239, ECB Guide to internal models, Fed SR1107). Data Quality Reports are

2023 Data Submission cycles are starting now!

The secured data portal is open for: Data Submissions Members are starting providing their latest data in the PD, LGD and Benchmarking platforms. For details on the submission timelines check the schedule in the link. Author Erik Rustenburg View all posts

GCD Recovery Rate Dashboards

Insight into observed recovery levels and other key benchmarks for various exposure classes, industry sectors and collateral types.

PD Dashboard: Large Corporate Defaults

Macroeconomic trends in 2022, initially marked by expectations of reduced government support for the pandemic, progressive tightening of monetary policies by central banks and rising inflaon rates must now consider market stress, energy cost surge and negative fallouts from the war in Ukraine. Concerns about new Covid-19 variants cannot be ignored neither.

GCD Data Quality 2022

Since 2004, GCD has continuously reinforced a framework that is used to measure and monitor Data Quality (DQ). The objective is to achieve high DQ and compliance for the GCD pooled data, as required by global regulations (BCBS 239, ECB Guide to internal models, Fed SR1107).

Downturn LGD Study 2020

Downturn LGD Study 2020 This Global Credit Data (GCD) study looks into the historical effects of previous downturns on bank credit losses across various debtor types, industries and regions, with a view to helping banks understand not only the high-level impacts of a downturn, but also how credit risk drivers

GCD North American Conference 2021

This year at Global Credit Data’s North American Conference GCD’s Members came together to discuss the pressing credit risk issues that banks are facing today.

GCD Data Quality

Since 2004, GCD has continuously reinforced a framework that is used to measure and monitor Data Quality (DQ). The objective is to achieve high DQ and compliance for theGCD pooled data, as required by global regulations (BCBS 239, ECB Guide to internal models, Fed SR1107). Author Izelle Kirsten View all

GCD North American Conference 2021 – Highlights

Welcome! On 19-20 October 2021, GCD hosted the second online North American Conference. This event was a huge success, with a great lineup of speakers. In case you missed it, here is a short summary of the conference To contact GCD, please contact secretary@globalcreditdata.org For more information and the slides, click here

Trade Finance Survey

The Asian Development Bank (ADB), the International Chamber of Commerce (ICC) and Global Credit Data (GCD) are conducting this survey to identify global market gaps in trade finance. The survey will help policy makers, regulators, and financial institutions better understand gaps and opinions on how they can be closed. The

GCD Middle East APAC Conference – Highlights

Welcome! On 27 May 2021, GCD launched its first event in the Middle East and APAC region. This event was a huge success, with a great lineup of speakers. In case you missed it, here is a short summary of the GCD Middle East APAC Conference To contact GCD, please

GCD Newsletter – February 2021

February 2021 Dear GCD members, This year, without blinking, GCD continues to address the unique global circumstances by facilitating data sharing on the crisis impact for comparisons between peers, creating influence in the regulatory conversation on Non-Performing Loans (NPL), and by contributing to the research on credit risk and

GCD Newsletter – December 2020

GCD December Newsletter: Let us move to 2021 December 2020 Dear GCD members, Each bank’s portfolio is affected differently by the crisis, depending on their specific footprint. However, GCD has remained steadfast in its mission as a data consortium. Will this crisis be worse, just as bad, or milder

LGD models must include unresolved defaults to avoid resolution bias, argues latest GCD study

PRESS RELEASE - December 1, 2020 Latest report from Global Credit Data highlights need for unresolved defaults to be incorporated into modelling process As the COVID-19 pandemic crisis continues, banks still face an uncertain impact on their credit risk assessment. Now, more than ever, it is of utmost importance to incorporate

LGD models must include unresolved defaults to avoid resolution bias, argues latest GCD study

Latest report from Global Credit Data highlights need for unresolved defaults to be incorporated into modelling process

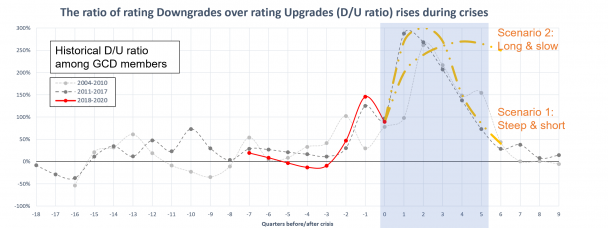

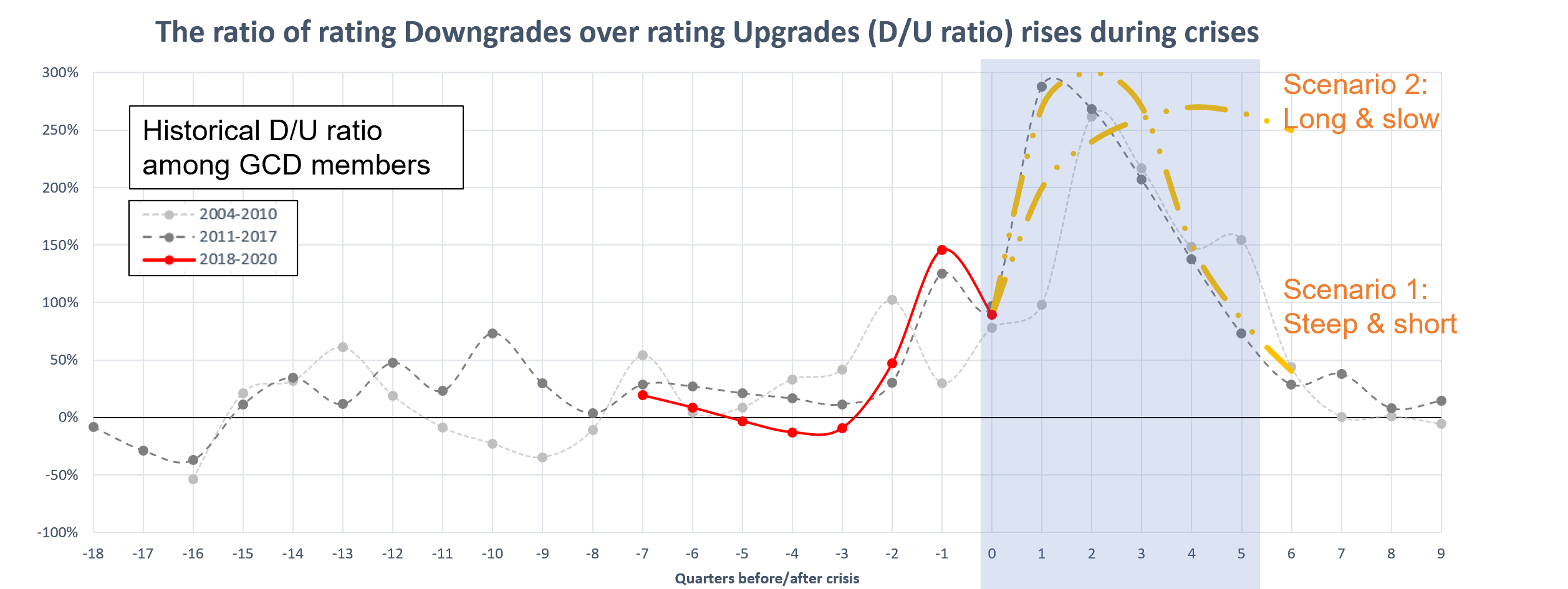

Rating Transitions: Get Results on the Impact of the Pandemic

The D/U ratio is calculated as the count of rating downgrades over the count of rating upgrades for a lender during a specific period. It captures the assessment of banks’ risk profile, as they assess it with their internal ratings. As such, it is a forward-looking view on banks’ projections

Rating Transitions: Get Results on the Impact of the Pandemic

The D/U ratio is calculated as the count of rating downgrades over the count of rating upgrades for a lender during a specific period. It captures the assessment of banks’ risk profile, as they assess it with their internal ratings. As such, it is a forward-looking view on banks’ projections

Capitalising on capitalisation: Can better capitalised banks minimise COVID-19-related losses by leaning on cash reserves? asks GCD study

PRESS RELEASE - October 22, 2020 Latest report from Global Credit Data analyses the impact of economic downturns on loss given default Results show that banks can weather the negative downturn effect by adapting their workout strategies The amount a bank loses on defaulted secured loans depends more on when

GCD Newsletter – October 2020

October 2020 Dear GCD members, GCD recently held its annual North American Conference, which took place for the first time in digital format. With over 250 attendees over the two days of the conference, and guest speakers from the Financial Accounting Standards Board (FASB) and American Bankers Association (ABA),

Restricted content

Submission portal is now open for H2 2020 cycle for Name and Cluster data collection. For Name Benchmarking participants: There are number of new names added to the Central list as well as enchancements made to the format of the cenral list excel file, so please review the changes and see if you can…

GCD Newsletter – September 2020

Dear GCD members, “Uncertainty” is a familiar word these days. “Data” seems an obvious answer. This bulletin brings to you some of GCD’s ongoing work and efforts to shed additional light on current credit risk challenges. Indeed, extensive data pooling and benchmarking activities appear to be needed now more