GCD Toronto Spring Conference 2024 Highlights

GCD expresses its gratitude to all the speakers, organizers, and attendees for an exceptional conference held in Toronto on Monday, April 29, 2024.

RBC (Royal Bank of Canada) served as an outstanding host for this remarkable occasion, bringing together credit risk professionals from both the USA and Canada to delve into the latest advancements in credit risk management.

The conference was characterized by thought-provoking sessions, stimulating questions and discussions between the audience and speakers, as well as roundtable discussions where participants felt comfortable addressing pressing industry matters with their peers and receiving immediate suggestions and solutions.

In response to the increasing demand for presentation materials, we have made them accessible below for GCD member bank employees, who are required to log in first.

For non-members, please don't hesitate to contact our North American executives, Hale and Akanna, for specific materials you would like to access.

To get a feel for what sessions you may like, please view the agenda here.

Download Presentation Slides from the Event

Presented by GCD Executive, Akanna Osita-Okeke

Get a glimpse into GCD data, global and Canadian data coverage, PD & LGD analytics reports and more

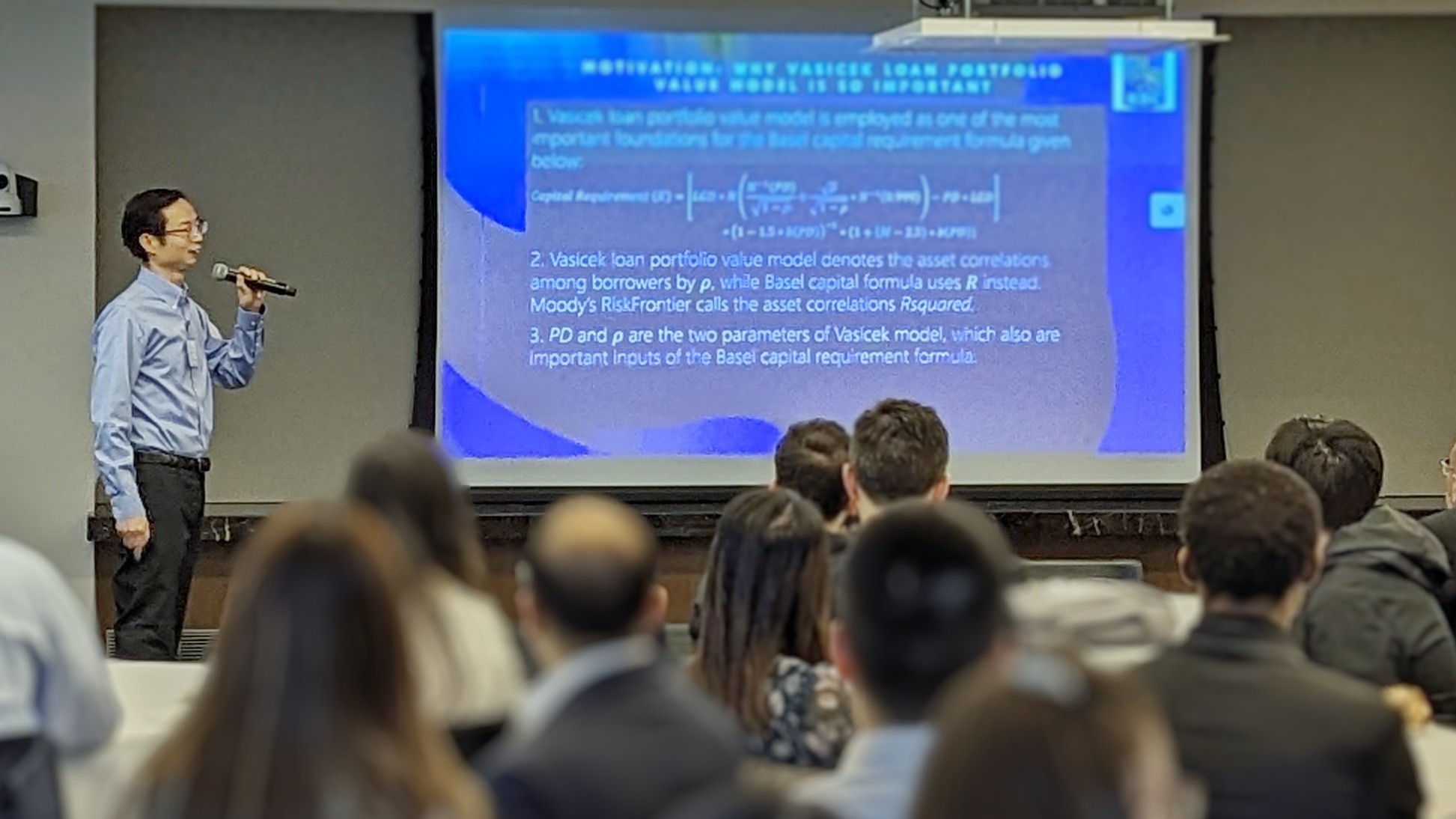

Presented by Biao Wu, Associate Director Credit Modeling at RBC

Discover a unique approach to adjusting asset correlations among borrowers through GCD default data, including how default-implied asset correlation can be used to explore credit risk characteristics and understand client behaviors across different risk categories.

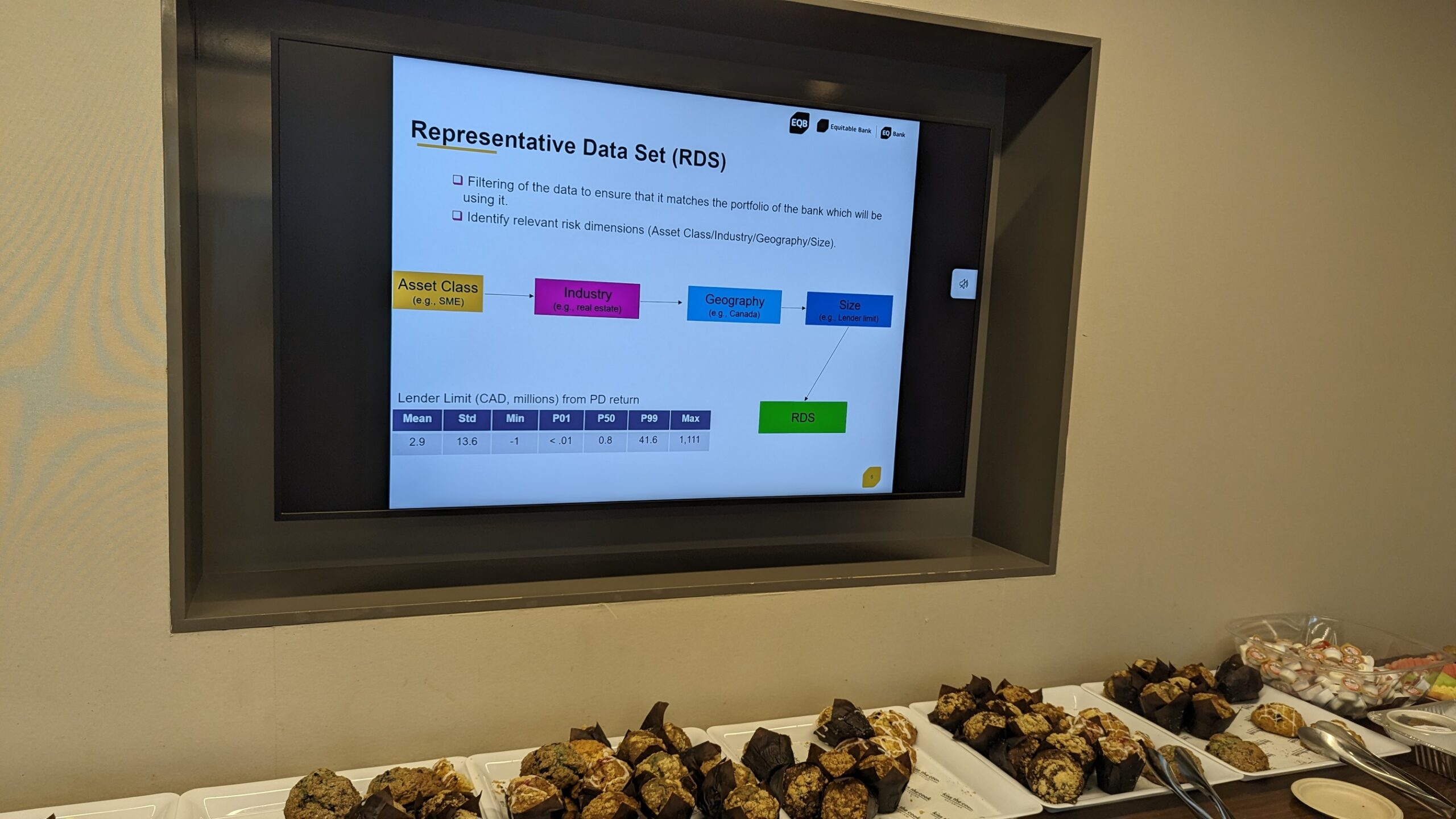

Presented by Joseph Tagne, Model Development Director at EQ Bank

Explore the possibilities of GCD data by delving into benchmarking default rates and observed losses, evaluating regulatory PD models, and understanding how LGD is affected by variables like discount factors.

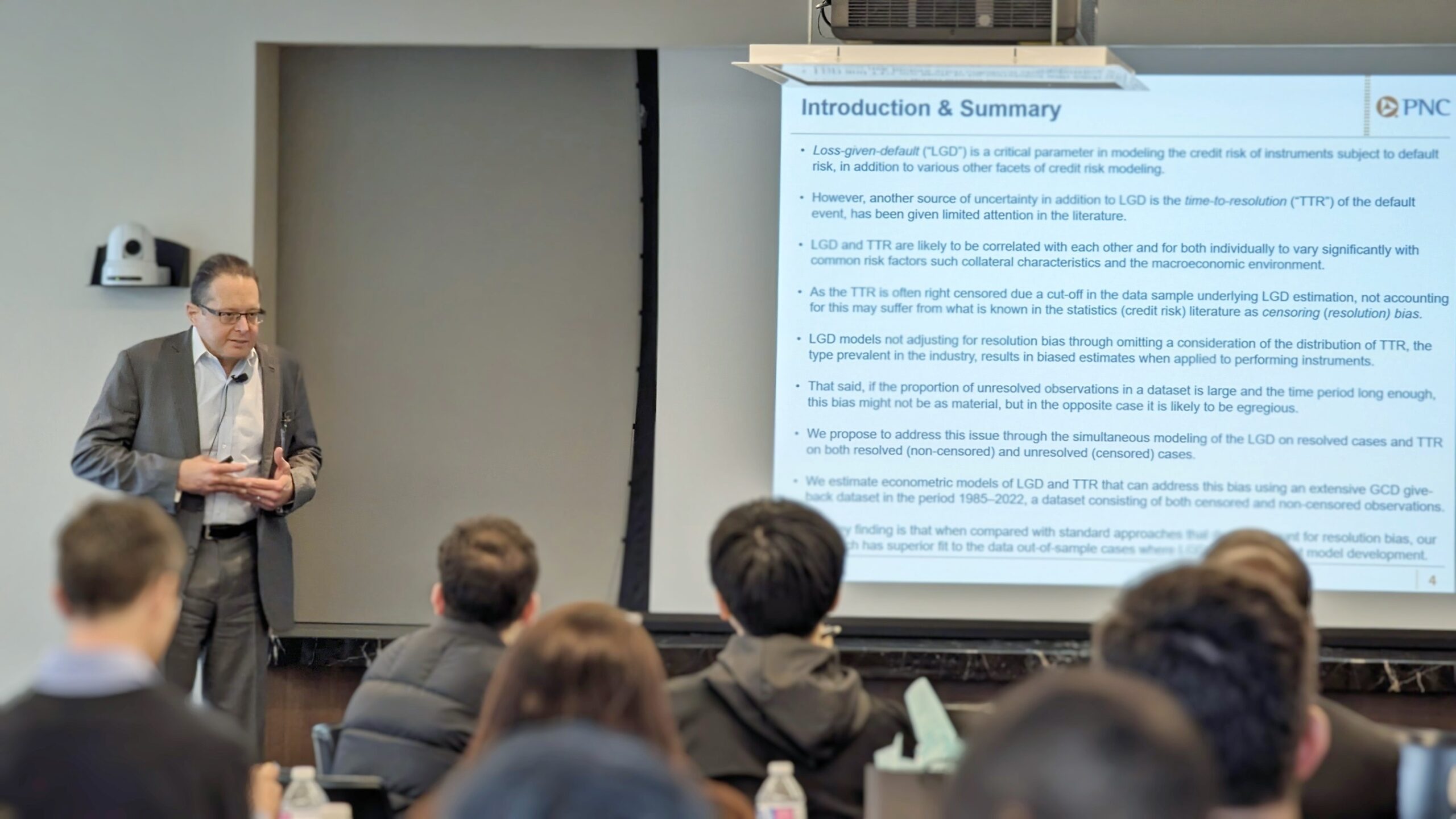

Presented by Michael Jacobs, Jr., Lead Modeling & Analytics Expert at PNC

LGD plays a crucial role in assessing credit risk, but the time-to-resolution (TTR) of default events is often overlooked in the literature. Discover the determinants of LGD and TTR through building alternative predictive econometric models using the GCD dataset.

Presented by GCD Executive, Nina Brumma

Learn how GCD data can help you in benchmarking your risk models.

ESG & Climate Risk Streams:

Presented by Hale Tatar (GCD)

Banks collaboration on benchmarking climate model approaches, portfolio impact assessment, insights on climate adjusted PD and Canadian regulator (OSFI) chosen method of Frye-Jacobs approach for calculating climate adjusted LGD in the latest Standardized Climate Scenario Exercise .

Presented by Hale Tatar (GCD)

Learn about B-15 guidelines, it's relation to the latest Canadian Sustainability Disclosure Standard (CSDS), integration to PCAF Net-zero targets.

Insights in to GCD's climate data collection activities, industry collaborations with international standard setters such as UNEPFI and NGFS.

Photo Gallery

We extend our heartfelt appreciation to everyone for making this event a resounding success, and we look forward to welcoming you again in the future!