Impressions from the GCD Amsterdam Conference 2023

Global Credit Data thanks all presenters, organizers and participants for another great conference in Amsterdam. ING was the perfect host to an incredible event with a special Dutch touch. Europe's credit risk professionals came together and discussed the latest developments in the credit risk management.

The conference was marked by numerous insightful sessions, each contributing to the success of the event. Here are some snapshots that capture the essence of the Amsterdam Conference 2023.

For those who couldn't attend or wish to revisit the conference sessions, you can download the presentations;

Download the presentations from the member website (for GCD members)

Download the presentations from the conference website (for attendees only, login to event page required)

The GCD Board Members and Executives extended a warm welcome to the attendees for the two-day, action-packed conference.

Hans Elbracht, Head of Model Risk Management at KfW, shared his insights on how to structure the model landscape and key areas for improvement.

During the presentation titled "Non-IRB LGD/EAD models as input for IFRS 9 and economic capital" by Rui Costa, Head of Cross Model Analytics at Wholesale Banking at ING, shared that it is important for banks to use external data. Discussing with peers and using external data like GCD helps substantiate some of our assumptions.

During the coffee breaks, attendees had the opportunity to network, exchange ideas, and build valuable connections.

During the conference, we received insights from Oana Maria Georgescu at ECB on the joint study by GCD-ECB, which looks into the sensitivity of loss-given-default to macroeconomic conditions. Additionally, there was a panel discussion focusing on topics such as Risk Modelling, Regulatory Compliance, and Beyond. Panel moderator; Matias Eklöf (FCG) and Panelists; Maz Khan (HSBC), Remy Haimet (Société Générale), Dilek Izek (Oliver Wyman)

Member Bank sessions by

Frederic Menninger, Miklós Verebélyi, Michael Schatz, Credit Suisse & UBS

Bogdan Sokalski, Daniela Thakkar ING

Otto ter Haar, Hanif Kamis, Marieke Bakker ING, Dirk Van den Acker Capstone Advisory

Mark Dutrisac, National Bank of Canada

Alexander Petrov, Nordea

Massimo Cutaia, UBS & Credit Suisse

Academic presentations from Jeroen Batema (Vrije Universiteit), Noah Urban, University of Duisburg-Essen

ESG Climate Risk sessions by Nicolas Ricard, Capgemini, Maurits Bakker, SAS, Matthew Smith, FCG, Niklas Haller, d-fine

Presentations from GCD Executives and Partners on Data and Methodology topics covering PD, LGD and EAD; Nina Brumma, Olivier Plaetevoet, Erik Rustenburg , Hale Tatar, Denisa Wagner Muth, Jakub Tomczyk, Benjamin Galow (d-fine), Antonio Ruiz,

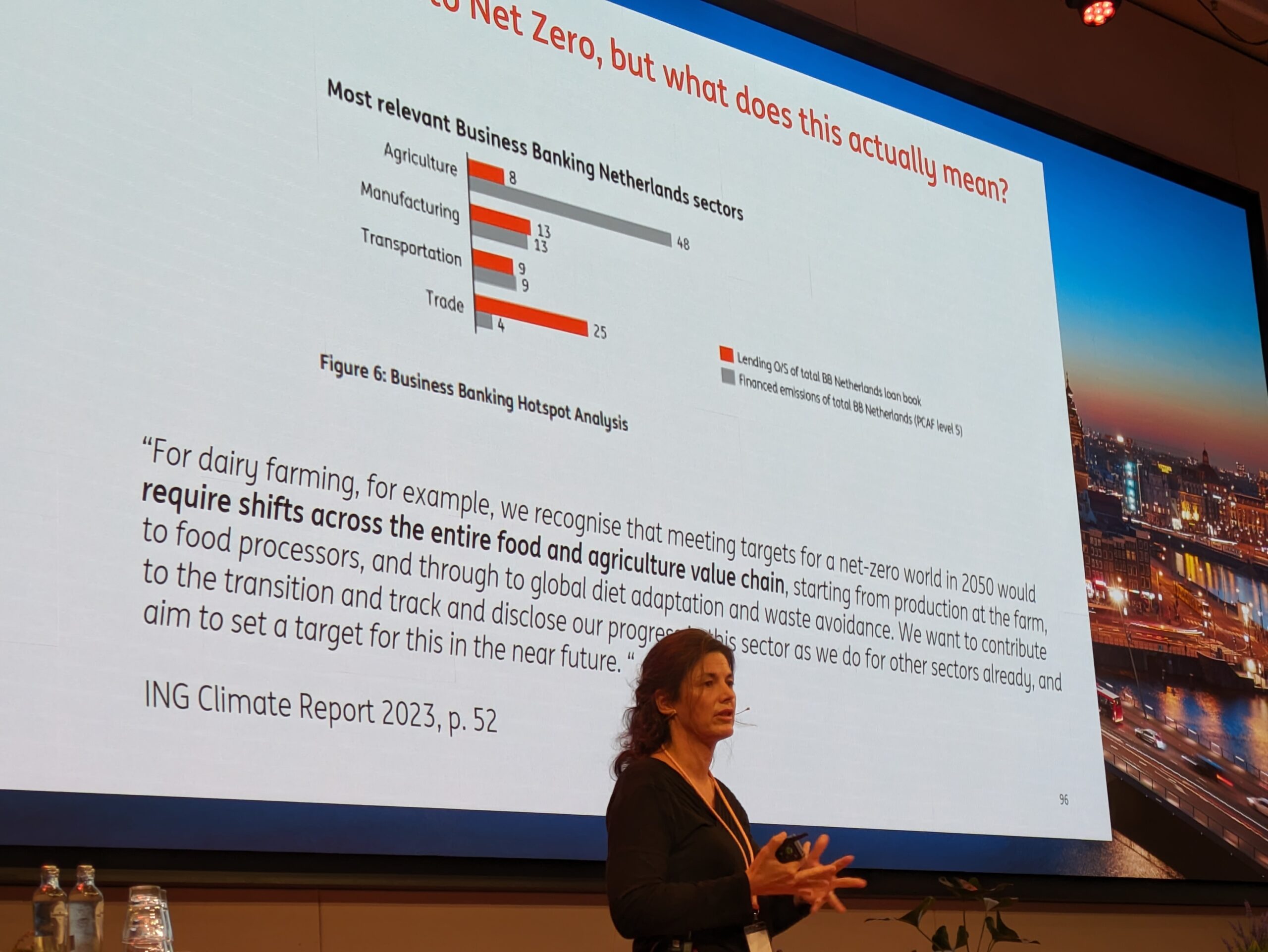

A captivating keynote session by Kim Verhaaf, Global Head of Financial Risk Modelling and Advanced Analytics at ING, joined by Amine Hamed, ING to share insights on Credit Risk, ESG climate and Data topics. The central theme emphasized the necessity for collaborative efforts within the banking industry and GCD is the best place for it! A relevant quote that Mr. Verhaaf shared is "If you want to go fast, go alone and if you want to go far, go together."

We had great presentations on the second day from member banks on uses of GCD Data.

GCD Trade Finance in action with Banking and Industry Authorities by Krishnan Ramadurai at HSBC and ICC Trade register.

We also heard from Markus Haverkamp at ING where he presented examples of GCD benchmarking in PD and Masterscale.

Numerous presentations and panel discussions centered around ESG and climate risk, generating substantial interest among banks eager to engage and exchange insights. The overarching consensus was that banks should unite their efforts in addressing ESG and climate-related challenges, with Global Credit Data playing a pivotal role in fostering collaboration through best practices, standardization, knowledge sharing, data sharing, and beyond.