GCD ESG and Climate Risk Solutions

where climate and credit risk measurement come together!

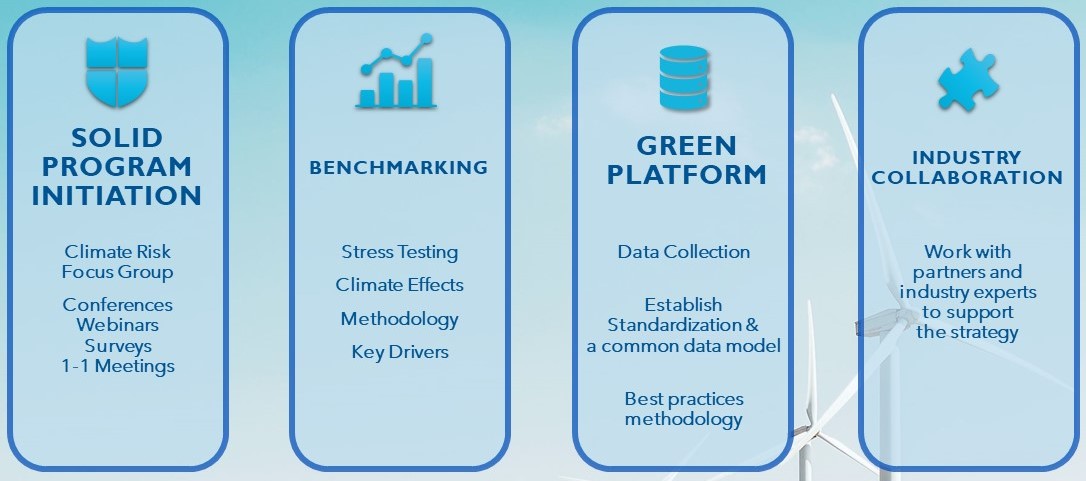

GCD's Climate Risk Focus group - formed of credit risk professionals from banks globally - aimed to help shape associations' approach to climate-related credit risks. The focus group serves as a center for collaboration and knowledge exchange among climate and risk experts.

Members of the focus group serve as an advisory group under the GCD Methodology Committee, and play a vital role in guiding GCD's efforts to address climate risks faced by financial institutions.

Members participate in information sessions, climate risk roundtables, technical workstreams, and practitioner sessions

Data collections

Surveys

Methodology Benchmarking

Peer comparison Study

Peer Discussions

Would you like to be involved?

Join the GCD Climate Risk Focus Group (CRFG) to be part of a collaborative and knowledge-sharing community for ESG, climate and risk experts.

GCD Member Banks

Global Credit Data currently has 50 member banks from North America, Europe, South Africa and Australia regions. More information about membership can be found here.

ESG & Climate Upcoming Events

GCD Nordic Forum Stavanger 19 September 2024

GCD Nordic Forum Stavanger 19 September 2024

Regulatory Climate Risk Resource Hub

This online resource serves as a central page for credit risk/ESG/climate risk professionals seeking information on climate risk management from various global regions, within the GCD membership base. The page is designed for easy navigation, enabling quick access to region-specific climate risk guidelines, reports and useful resources. Please note that this list is not exhaustive and is subject to updates as necessary.

Europe

European Banking Authority (EBA)

- EBA Draft Guidelines on management of ESG Risks - consultation paper (2024)

- EBA industry survey on the classification of exposures to ESG risks (2024)

- One-off Fit-for-55 climate risk scenario analysis. (2023)

- Results of its 2023 EU-wide stress test (2023)

- Report on enhancements to the Pillar 1 framework to capture environmental and social risks (2023)

- Technical standards (ITS) on Pillar 3 disclosures on Environmental, Social and Governance (ESG) risks.

- EBA Roadmap on Sustainable Finance (2022)

European Central Bank (ECB)

- ECB Paper: Road to Paris: stress testing the transition towards a net-zero economy (2023)

- ECB report on good practices for climate stress testing (2022)

- SSM supervisory priorities for 2023-2025

- Results of the 2022 thematic review on climate-related and environmental risks (2022)

- Results of the 2022 climate risk stress test of the Eurosystem balance sheet (2022)

UK

Prudential Regulation Authority (PRA).

- Bank of England report on climate-related risks and the regulatory capital frameworks (2023)

- Bank of England and Prudential Regulation Authority (PRA) conference material on climate change and capital (2022)

- Results of the 2021 Climate Biennial Exploratory Scenario (CBES)

Canada

Office of the Superintendent of Financial Institutions (OSFI)

- Guideline B-15: Climate Risk Management, new Climate Risk Returns, What We Heard Report (2024)

- B-15 Guideline on financial institutions management of climate-related risks : Climate Risk Management (2023)

- Standardized Climate Scenario Exercise (SCSE) 2023 draft

- Results: Bank of Canada-OSFI Climate Scenario Analysis Pilot (2022)

United States

Federal Reserve (Fed), Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC)

- US FED Climate Scenario Exercise - Results (2024)

- The Enhancement and Standardization of Climate-Related Disclosures for Investors, Securities and Exchange Commission (SEC) (2024)

- Principles for Climate-Related Financial Risk Management

for Large Banks (2023) - Paper on What are Large Global Banks Doing About Climate Change? (2023)

- Pilot Climate Scenario Analysis (CSA) Exercise (2023)

Australia &

New Zealand

Australian Prudential Regulation Authority (APRA)

- Results from Climate Vulnerability Assessment (CVA) of Australia’s five largest banks. (2022)

- Climate risk self-assessment survey

- Prudential Practice Guide CPG 229 Climate Change Financial Risks

South Africa

Prudential Authority (PA), The South African Reserve Bank (SARB)

- Proposed Guidance Note-Climate related disclosures for banks (2023)

- Climate change modelling framework for financial stress testing in Southern Africa (2022)

- Prudential Communication for Climate–related risks (2022)

- Prudential Authority Climate Survey Report 2021

Past Events

GCD Australian Regional Meeting

GCD Australian Regional Meeting

Australian Regional Meeting 25th July, 2024 from 9.00am - 12.00pm AEST

GCD and UNEP FI – Credit Risk Assessment Methodologies for Climate Change – Information Session

GCD and UNEP FI – Credit Risk Assessment Methodologies for Climate Change – Information Session

We are delighted to invite you to the GCD and UNEP FI webinar “Global benchmarking survey on credit risk assessment methodologies for climate change” on Thursday, July 11, 2024. Global Credit Data (GCD) and the United Nations Environment Programme Finance Initiative...

GCD Climate Risk Focus Group | ESG scoring for financial institutions

GCD Climate Risk Focus Group | ESG scoring for financial institutions

ESG scoring for financial institutions Wednesday, June 26th at 09:00 EDT/15:00 CEST Registrations are sent to focus group members This session is a part of the GCD Climate Risk Focus Group's webinar series. The focus group serves as a center for collaboration and the sh...

GCD Climate Risk Webinar for Australian Banks: Emerging regulatory landscape and modelling

GCD Climate Risk Webinar for Australian Banks: Emerging regulatory landscape and modelling

Webinar for Australian Banks: Emerging regulatory landscape and modelling Thursday, June 20th, 2024 (TBC) Registrations are sent to focus group members This session is a part of the GCD Climate Risk Focus Group's webinar series. The focus group serves as a center for co...

GCD Climate Risk Focus Group | Towards short-term climate scenarios: the NGFS approach

GCD Climate Risk Focus Group | Towards short-term climate scenarios: the NGFS approach

Towards short-term climate scenarios: the NGFS approach Wednesday, May29th, at 09:00 EDT/15:00 CEST The NGFS team at European Central Bank (ECB) is meeting with GCD Climate Risk focus group members once more for the second part of the information session series on Wedne...

GCD DACH Forum in Frankfurt

GCD DACH Forum in Frankfurt

Global Credit Data invites you to the first DACH Forum in Frankfurt In cooperation with our partner d-fine We cordially invite you to our first German-language GCD conference - with relevant topics and a venue near you. Exchange ideas at our half-day event on the topi...

GCD Climate Risk Focus Group | Rabobank presentation: ESG risk score

GCD Climate Risk Focus Group | Rabobank presentation: ESG risk score

Speaker: Sander Scheerders, Rabobank Where: MS Teams This session is part of the GCD Climate Risk Focus Group's bank webinar series. The focus group serves as a center for collaboration and the sharing of expertise among ESG, climate, and risk professionals from banks...

GCD Climate Risk Focus Group | An Integrated Credit/Climate Scenario Approach

GCD Climate Risk Focus Group | An Integrated Credit/Climate Scenario Approach

Join us for the upcoming webinar on Wednesday, May 8th at 10:00 EDT / 16:00 CEST / 15:00 BST with Scott Aguais and Larry Forest as they share insights on Modelling Credit/Climate Analytics and Scenarios. Speakers will present a detailed approach for developing climate ...

GCD Toronto Conference – Spring 2024

GCD Toronto Conference – Spring 2024

Unique Conference by Banks for Banks Hosted by the Royal Bank of Canada (RBC), GCD Toronto conference promises to be an exceptional opportunity for bank professionals to come together and exchange knowledge, insights, and best practices while building valuable connecti...

GCD Climate Risk Focus Group | Long-term NGFS Climate Scenarios and Overview of Data

GCD Climate Risk Focus Group | Long-term NGFS Climate Scenarios and Overview of Data

Speakers: ECB NGFS Climate Team: Clemens-Maria Lehofer and Senne Aerts Where: MS Teams This session is part of the GCD Climate Risk Focus Group's webinar series. The focus group serves as a center for collaboration and the sharing of expertise among ESG, ...