- This event has passed.

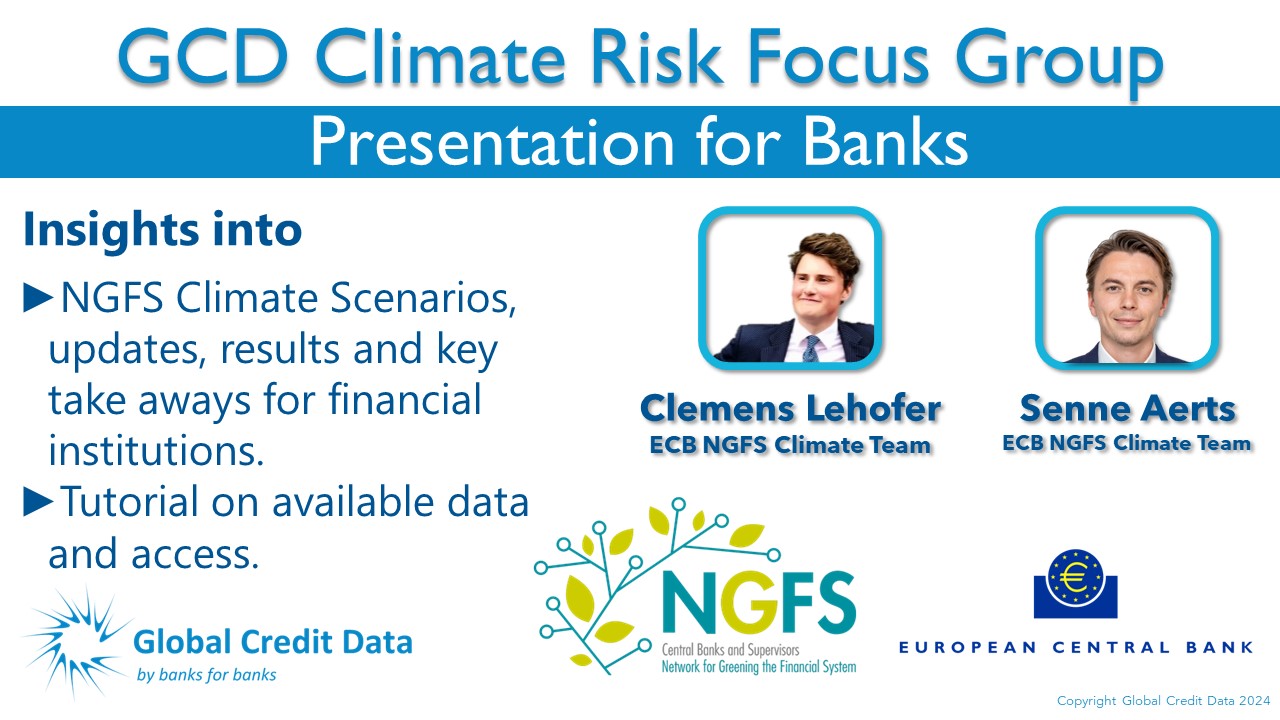

GCD Climate Risk Focus Group | Long-term NGFS Climate Scenarios and Overview of Data

April 17 @ 8:00 am - 9:00 am EDT

Speakers: ECB NGFS Climate Team: Clemens-Maria Lehofer and Senne Aerts

Where: MS Teams

This session is part of the GCD Climate Risk Focus Group‘s webinar series. The focus group serves as a center for collaboration and the sharing of expertise among ESG, climate, and risk professionals from banks and industry experts worldwide.

Webinar details:

As the sophistication of climate risk assessments increases, regulatory expectations grow, and financial institutions commit to net-zero targets, the relevance of climate scenarios for the financial sector continues to rise. Given the emerging importance of these scenarios, it is imperative that users fully understand the nature of climate scenarios, and that scenario designers appreciate the financial sector applications of their work. Ongoing dialogue between modelers and financial sector users will result both in better integration of these scenarios into financial decision-making and continued enhancement of the scenarios themselves. This session will present an overview of the latest release of the NGFS Climate Scenarios, including updates, results and key take aways for financial institutions. Additionally, the session will include a tutorial on available data and access.

Register for the Webinar