Key Takeaways

This year at Global Credit Data’s North American Conference GCD’s Members came together to discuss the pressing credit risk issues that banks are facing today. Global Credit Data was proud to have hosted several important guest speakers this year featuring talks from the American Bankers Association (ABA), the International Institute of Finance (IIF), Accenture, and many more.

Highlights

Member Testimonies

GCD Data in Action: Member roundtable on GCD data for modelling

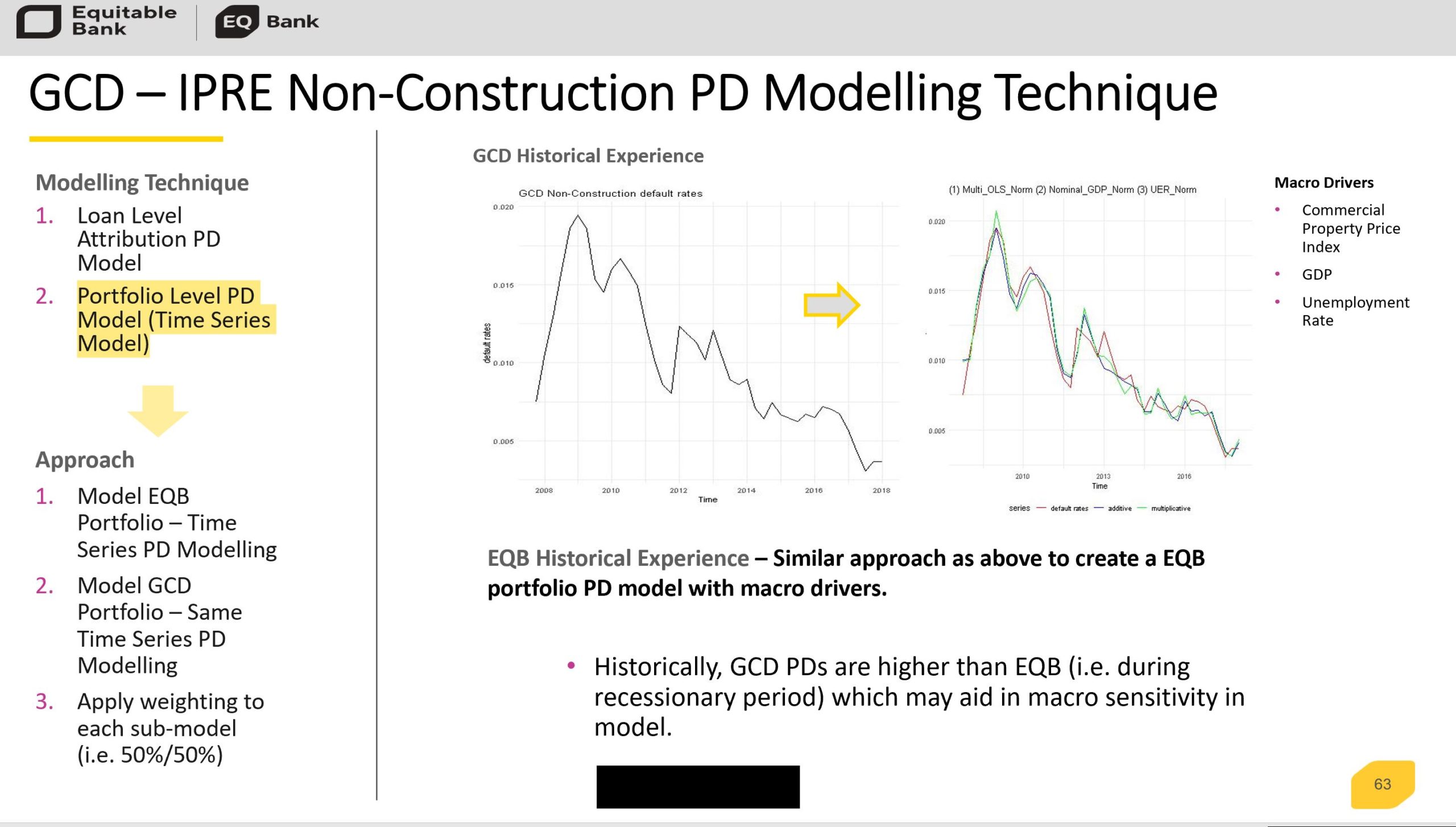

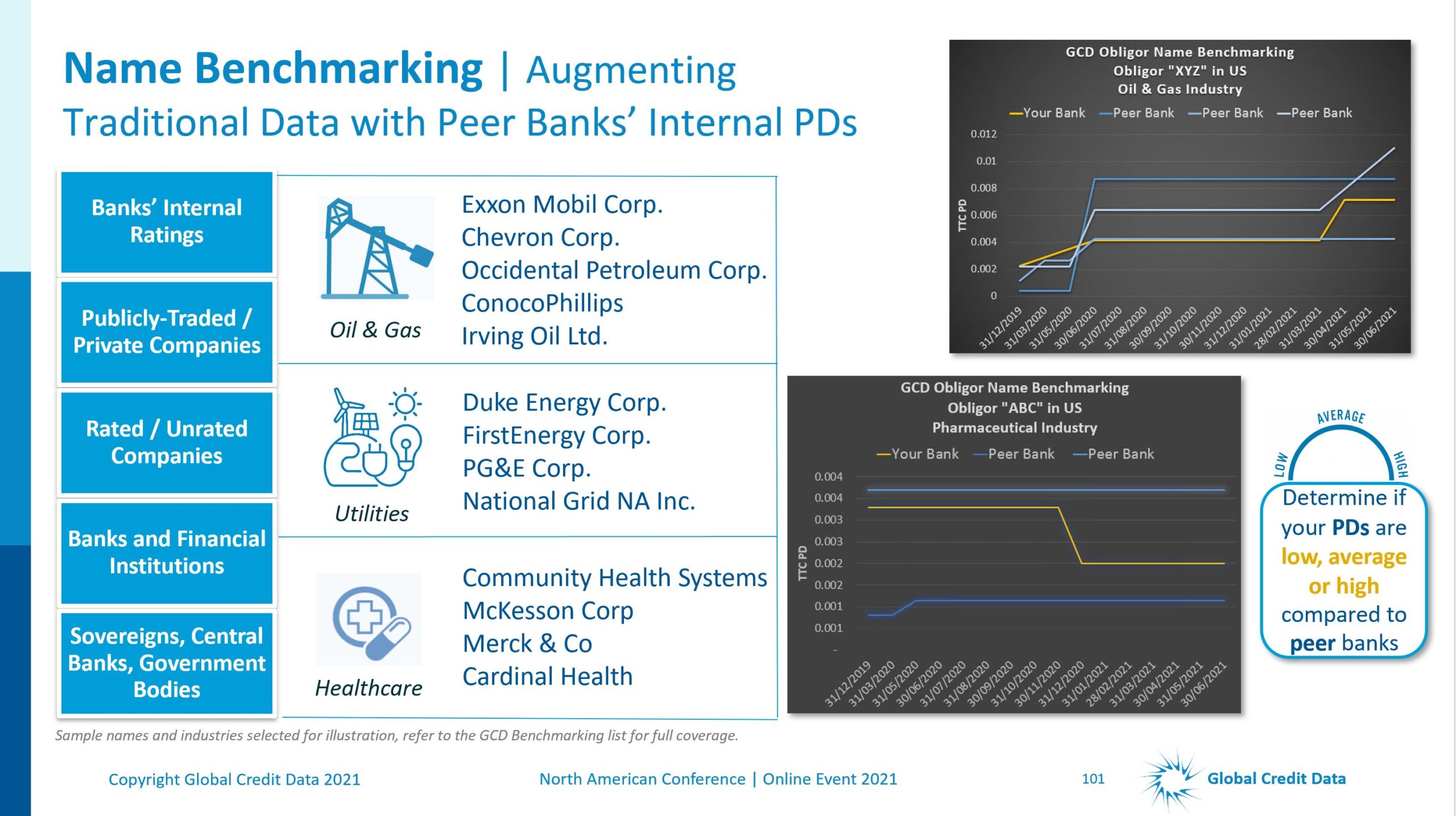

Presented by Member Banks: M&T Bank and Equitable Bank

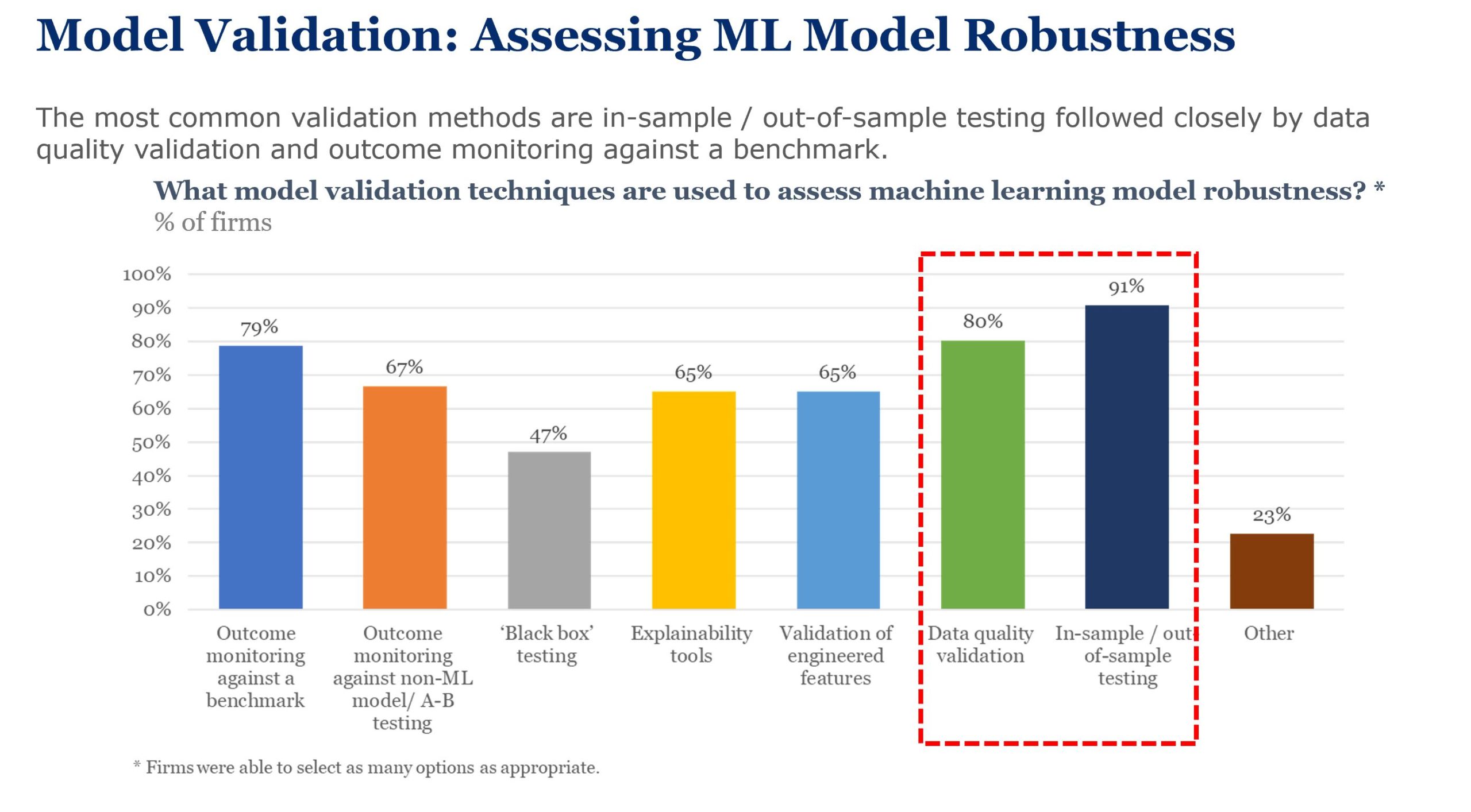

Machine Learning

Model Risk Management: Model Validation, Machine Learning Governance

Presented by Natalia Bailey (IIF)

Resources

Day 1

| Opening GCD Overview and Conference Program | Slides |

| The state of commercial banking and projections in 2022 | Slides |

| Model Risk Management: Model Validation, Machine Learning Governance | Slides |

| Data Quality (DQ) as an Asset | Slides |

| GCD Data in Action: Member roundtable on GCD data for modelling | Slides |

| Regulatory Perspectives on Third-Party Data | Slides |

| Comparing banks’ Stress Testing practices: GCD and CRISIL’s data-driven industry advisory study | Slides |

| Pandemic Recovery | Slides |

|

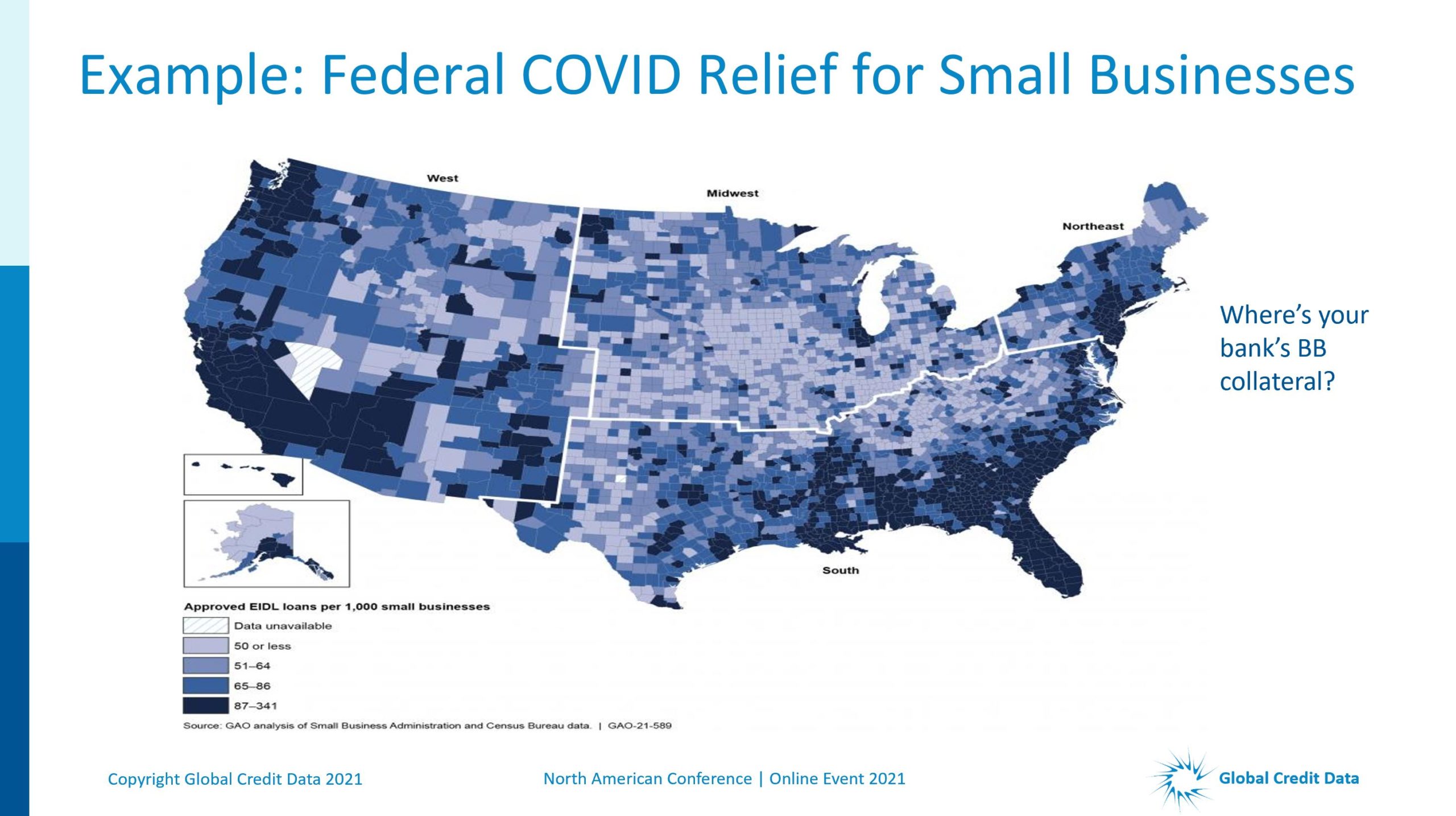

GCD Academic Work & Modeling Recovery Rates of Small- and Medium-Sized Entities in the US

|

Slides |

Day 2

| Opening and welcome remarks | Slides |

| CRE lending at the front lines: a perspective on the state of Commercial Real Estate Lending and the challenges ahead. | Slides |

| GCD Collateral’s Comparable Service | Slides |

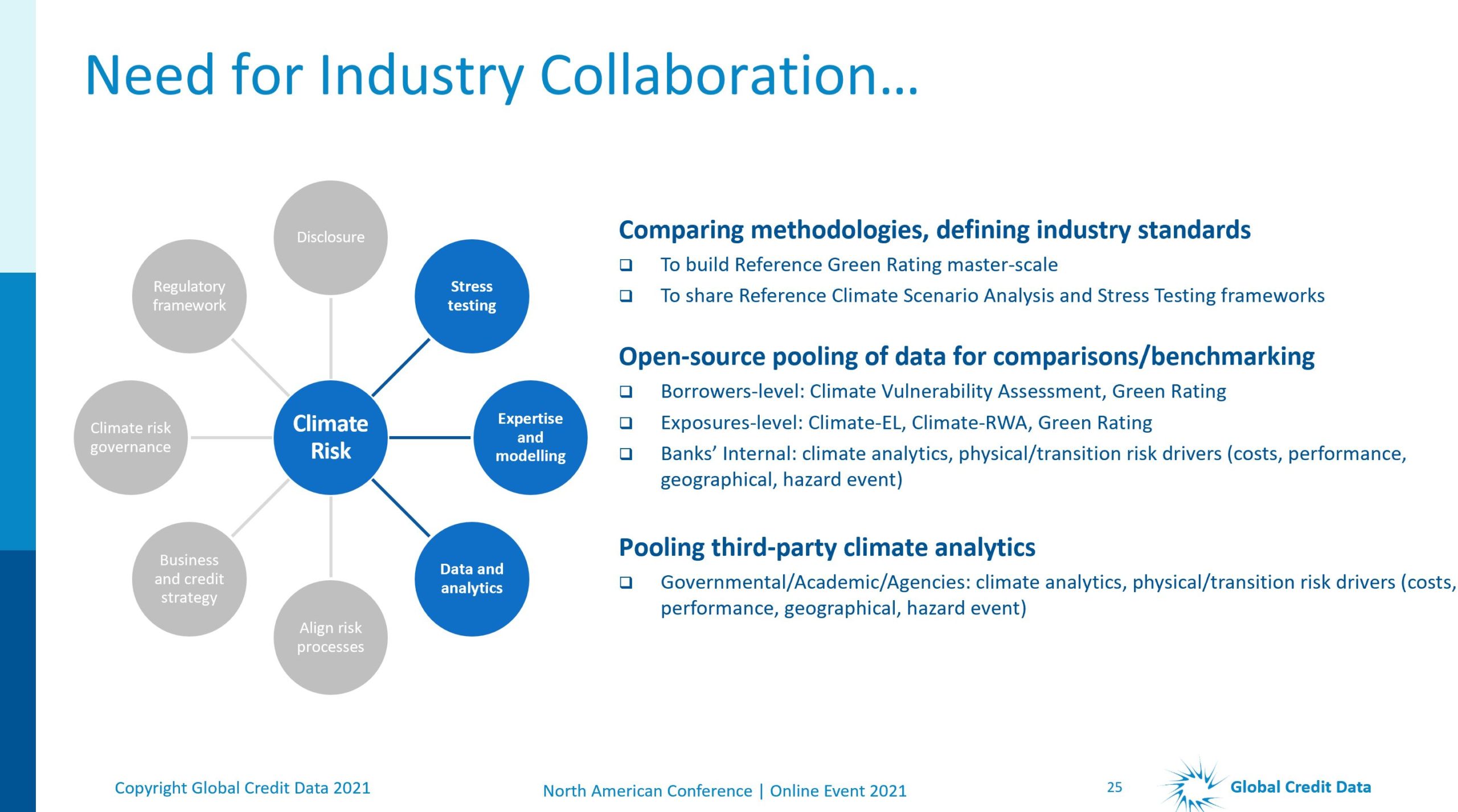

| Climate Risk Contribution /GCD and Contributions to Climate Risk Data Sharing | Slides |

| An Initial Look at Modeling Challenges during COVID-19 | Slides |

| Collaboration with ADB and update on Trade Finance | Slides |