Global Credit Data collects raw data from its members and distributes it back to them for use in their own analysis and modelling.

Full data return and reference data set

Member banks always receive a full data return of the aggregated data and are encouraged to create their own filters to produce a representative data set appropriate to their bank’s geographical presence, business types and practices. This enables banks to use the data for different tyes of benchmarking tailored to their needs. For further information, please check our Reference Dataset Guidelines

The ultimate benchmarking: Peer Comparison reports

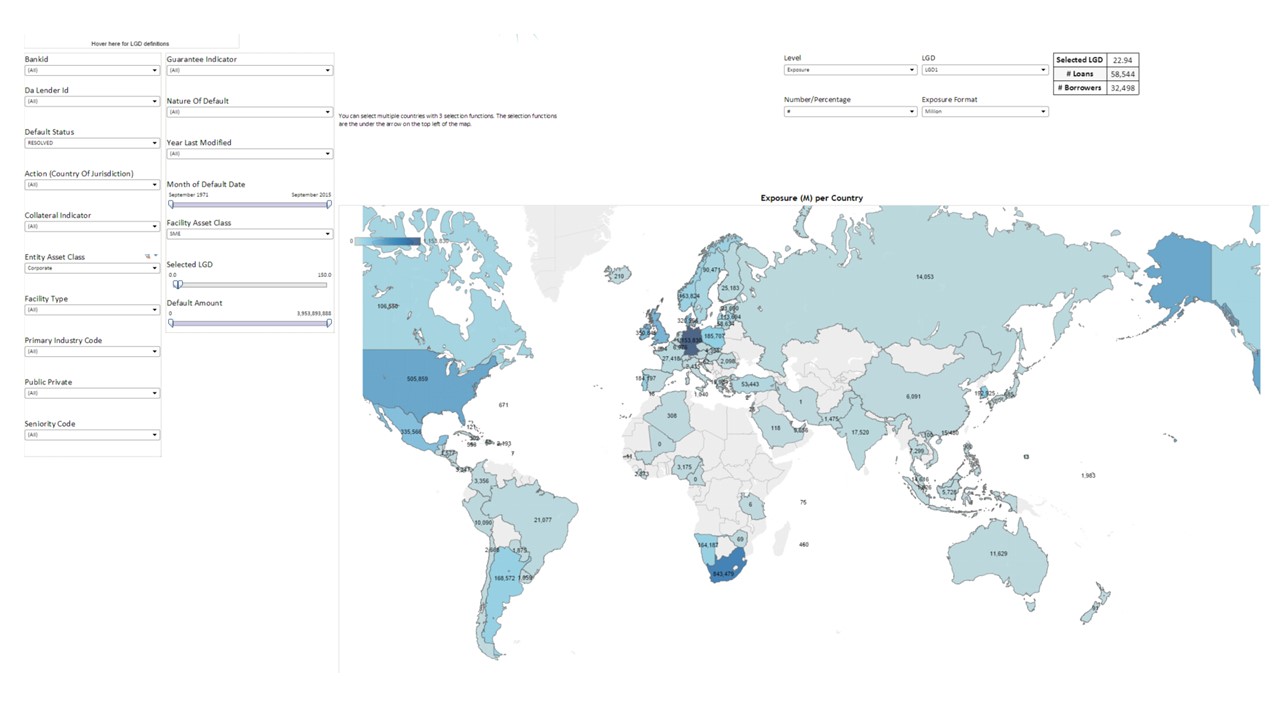

Easy acess to our data

GCD supports its members by providing a flexible high-end tool on the data pool: the GCD Visual Analyzer. Member banks can create dynamic Reference Data Sets and generate instant views on the data.