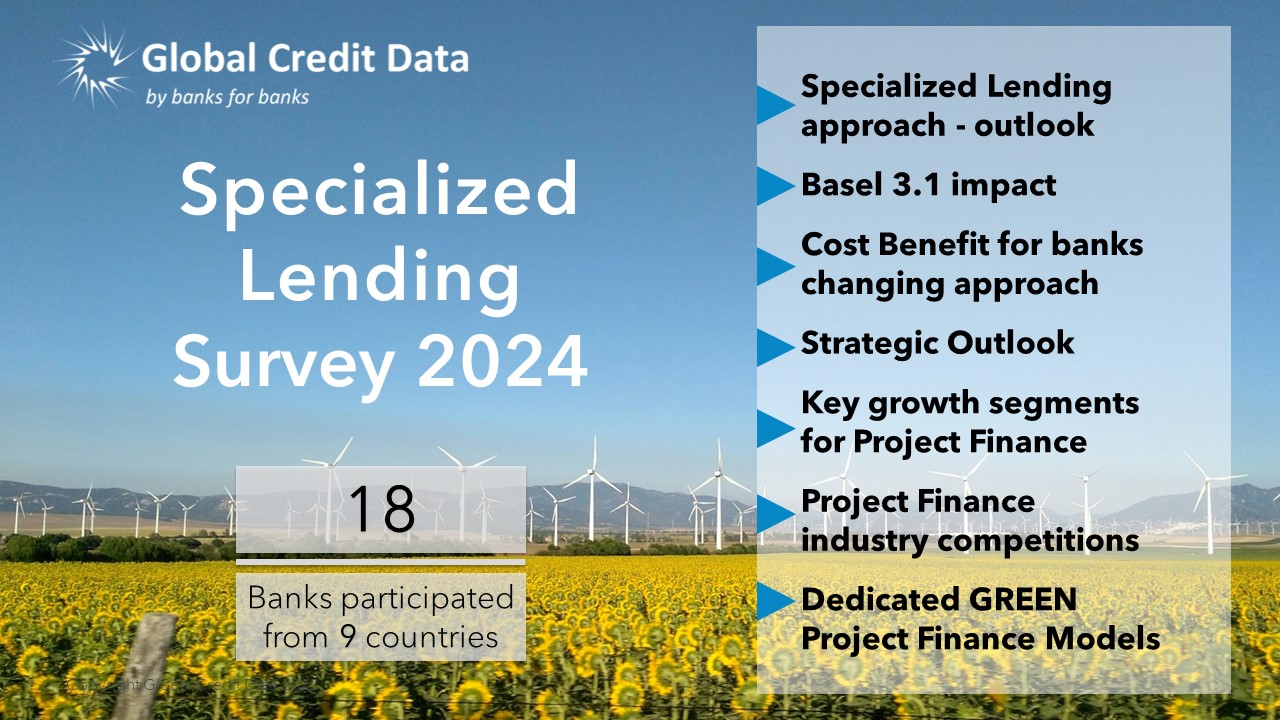

Specialized Lending Survey

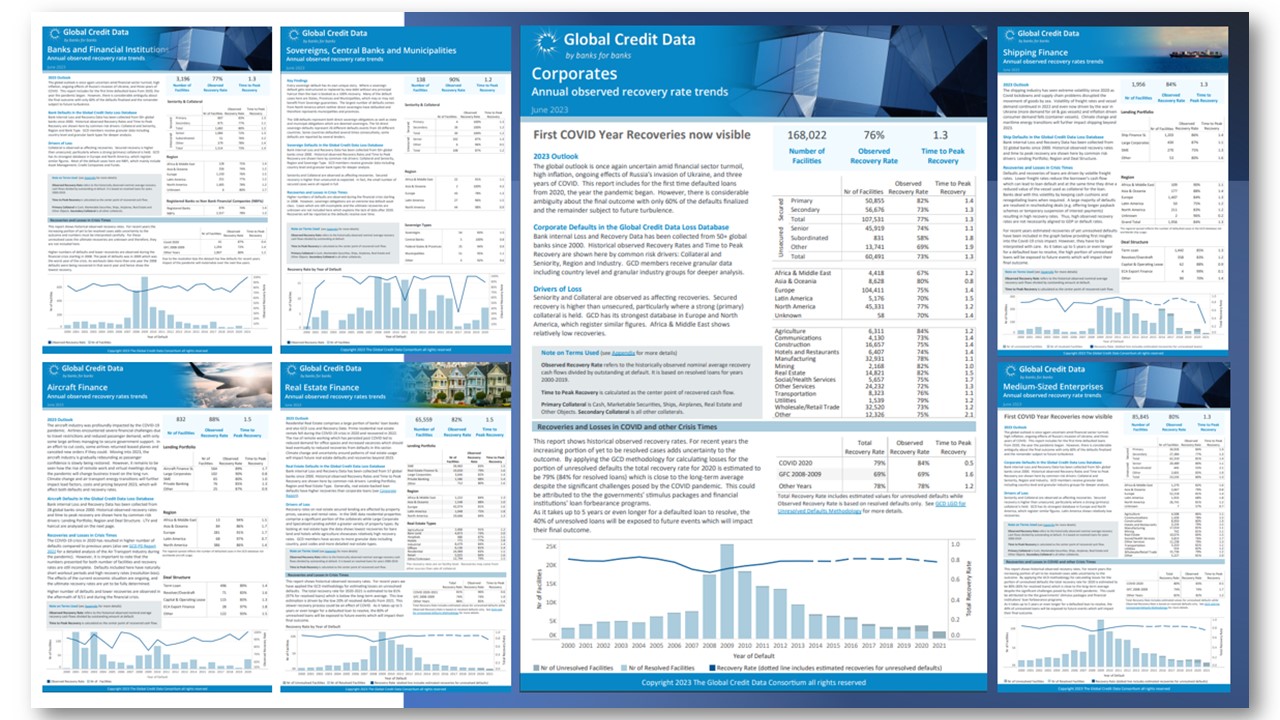

Understanding and managing risks effectively requires robust data. This is especially challenging for low default portfolios like Specialised Lending, meaning banks often lack sufficient internal defaults for modeling. Also in the regulatory context, requirements for data availability are tough to meet. This often results in high Margins of Conservatism, making IRB models for SL less profitable. To address this, many banks are leveraging external data such as GCD’s data pools, with 50% of those in our survey adopting this approach.

Project finance, a key segment of SL, is particularly vital for the transition to green energy. 90% of survey participants highlighted renewable energy as a crucial segment for future growth.

Our survey provides a detailed overview of how 18 banks from 9 countries are preparing for the future of Specialised Lending. It covers regulatory actions, portfolio development, and strategic approaches. With these insights, banks can align their strategies more effectively and optimize models ensuring they remain competitive and contribute to a sustainable future.

Results are available to participant banks only.

Please contact Nina Brumma for further information and to participate in SL intiatives.