Global Benchmarking Survey for Banks

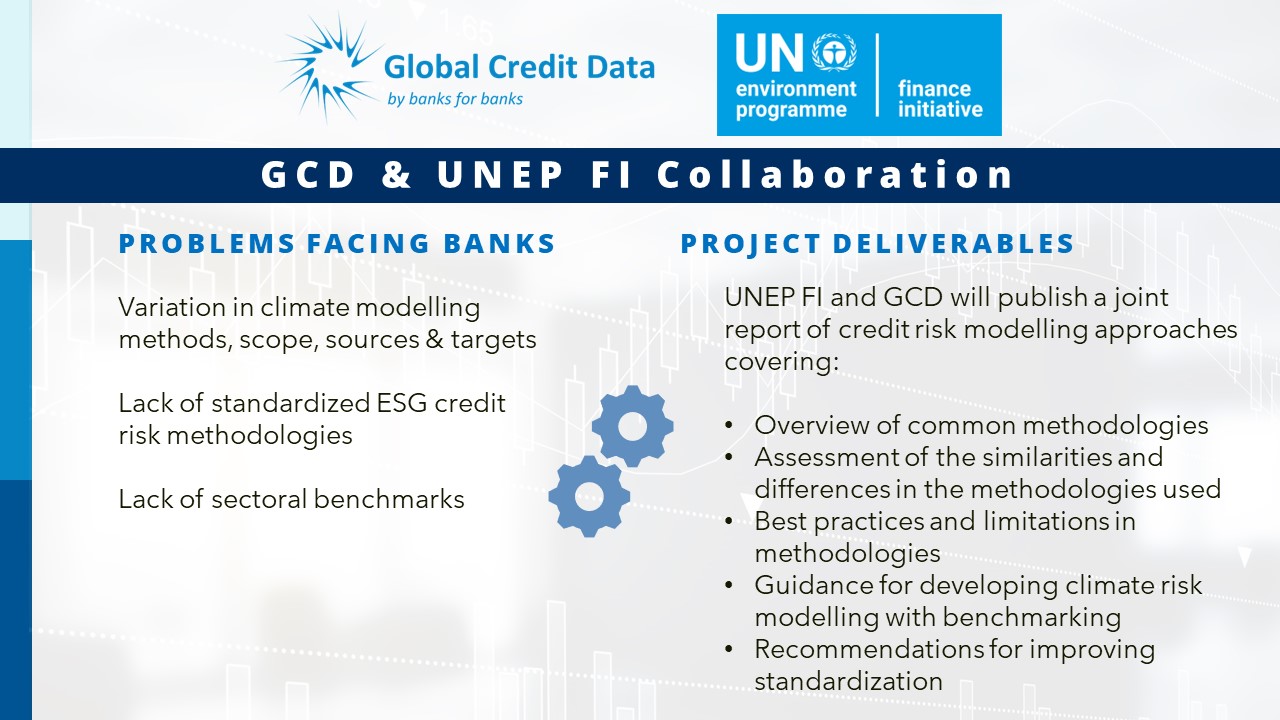

Global Credit Data (GCD) and the United Nations Environment Programme Finance Initiative (UNEP FI) have recently embarked on an important partnership aimed at enhancing ESG and climate risk efforts. This collaboration focuses on advancing the methodologies and benchmarks used by financial institutions to assess and manage climate risks.

Access Project Details

Fill Participation Form

Fill the Survey!

Project kickoff webinar presented details on the activities and how banks will participate.

Access the slides here

Banks can now register to participate in the survey. Fill this form

Survey will begin with participant banks.

Objectives of the project:

The collaboration will identify common credit risk assessment methodologies, provide a benchmark for modeling approaches for climate risk assessment used by financial institutions, and explore how the quantification of climate risks can be impacted by variations in assessment methodologies.

Value for Participants:

GCD and UNEP FI will publish a comprehensive report that benchmarks and compares the various credit risk modelling approaches used by financial institutions to assess climate risks.

This report will include overview of methodologies, information on data used, scenarios and models applied, variables and metrics selected, methodological comparisons, best practices, and the standardization of climate risk modeling practices across the financial sector. It will also provide insights into the progress financial institutions have made in their climate risk assessment approaches.

Key Sections of the Survey:

Climate-Related Credit Risk Assessment and Integration

Transition & Physical Risk specific focus

Collateral Value Adjustments

Sector-Specific focus

Scenario Analysis

ESG Scores

Data & IT

Quantitative Impact on Metrics like ECL, RWA, and ECAP

Would you like to participate?