GCD Newsletter – March 2023

Read the March 2023 Newsletter here....

GCD Data Quality Dashboard 2023 – available

Since 2004, GCD has continuously reinforced a framework that is used to measure and monitor Data Quality (DQ). The objective is to achieve high DQ and compliance for the GCD pooled data, as required by global regulations (BCBS 239, ECB Guide to internal models, Fed...

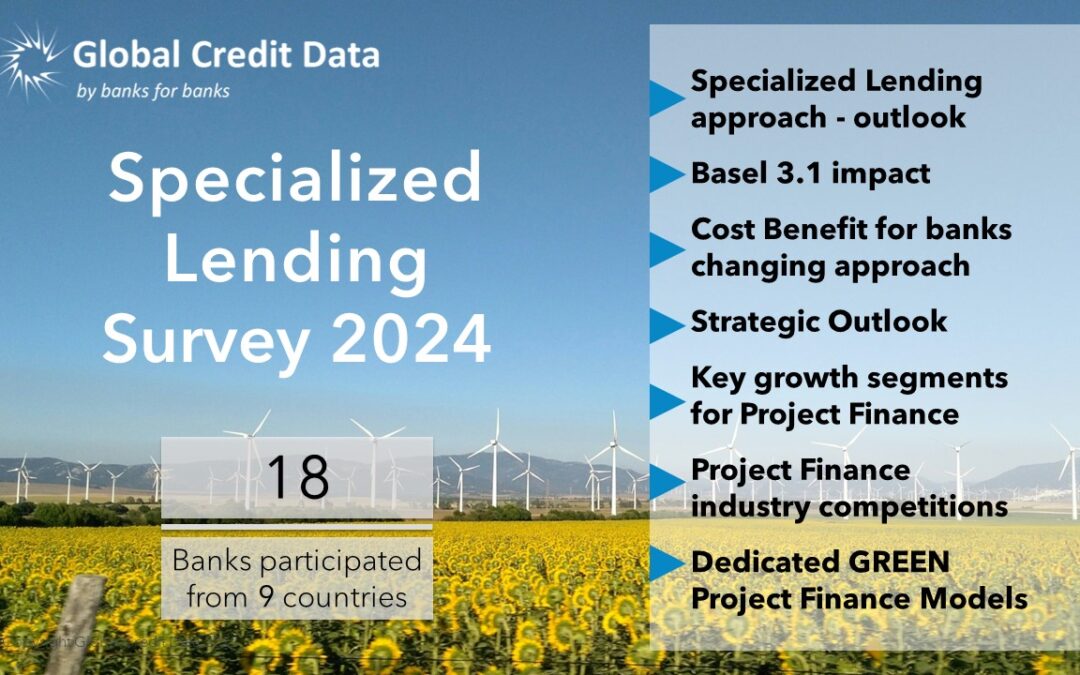

GCD Specialized Lending Survey 2024

Specialized Lending Survey Understanding and managing risks effectively requires robust data. This is especially challenging for low default portfolios like Specialised Lending, meaning banks often lack sufficient internal defaults for modeling. Also in the...

Climate Risk Benchmarking Survey by GCD and UNEP FI – Registration Now Open!

Pandemic Aftermath: GCD Data Reveals Decline in US Real Estate Recovery Rates

New Report Highlights Impact of COVID-19 on U.S. Commercial Real Estate Pandemic Aftermath: GCD Data Reveals Decline in US Real Estate Recovery Rates July 19, 2024 – GCD today announces the release of the "US Real Estate Recovery Rates Report - Sectoral Comparison of...

2024 H1 Cycle Data returns released on GCD Platforms!

GCD Platforms Release Comprehensive H1 Cycle Data Returns The latest data returns for the H1 cycles have been released on all GCD platforms. This release provides banks with the most current and comprehensive data for Probability of Default (PD) and Loss Given Default...

News: GCD and UNEP FI Collaboration

News GCD and UNEP FI Collaborate to Enhance ESG and Climate Risk Efforts Global Credit Data (GCD) and the United Nations Environment Programme Finance Initiative (UNEP FI) are pleased to announce their partnership. This partnership aims to advance the methodologies...Press Release: The Global Credit Data Consortium appoints Ramadurai Krishnan as CEO

GCD Toronto Spring Conference 2024...

GCD Toronto Spring Conference 2024 Highlights

GCD Toronto Spring Conference 2024 Highlights GCD expresses its gratitude to all the speakers, organizers, and attendees for an exceptional conference held in Toronto on Monday, April 29, 2024. RBC (Royal Bank of Canada) served as an outstanding host for this...

NGFS Climate Scenarios Q&A

Presentation can be accessed here. Are compound risks also included? No compound risks are not yet covered by the scenarios at this point in time. This limitation has also been noted by us, and we have drafted a note that covers the topic, and explains how this could...

Climate Focus Group Update March 2024: Climate Stress Testing, Global Events & Regulatory News and more

GCD Climate Risk Focus Group where climate and credit risk measurement come together! Dear GCD Members and Friends, Stay informed with the latest activities in Climate Risk at GCD: Information on upcoming webinars featuring insights on Climate Stress testing from the...