GCD Newswire

Global Credit Data members work together to analyse the data and discuss methodology issues. GCD has published up until now the following papers.

Interested in a more condensed view? Explore our Interactive Dashboard. It provides instant insight into observed recovery levels and other key benchmarks for various exposure classes, industry sectors, and collateral types.

GCD is looking to hire a Senior Quantitative Analyst in Europe

We are thrilled to announce an exciting job opportunity at Global Credit Data (GCD)! Find out more and apply here:

GCD Model Tiering Survey Results Released

Detailed survey on how banks classify models for model risk management purposes. These insights highlight the critical role of model tiering in enhancing risk management practices across the banking sector.

Climate Risk Benchmarking Survey by GCD and UNEP FI – Registration Now Open!

Survey to advance the methodologies and benchmarks used by financial institutions to assess and manage climate risks.

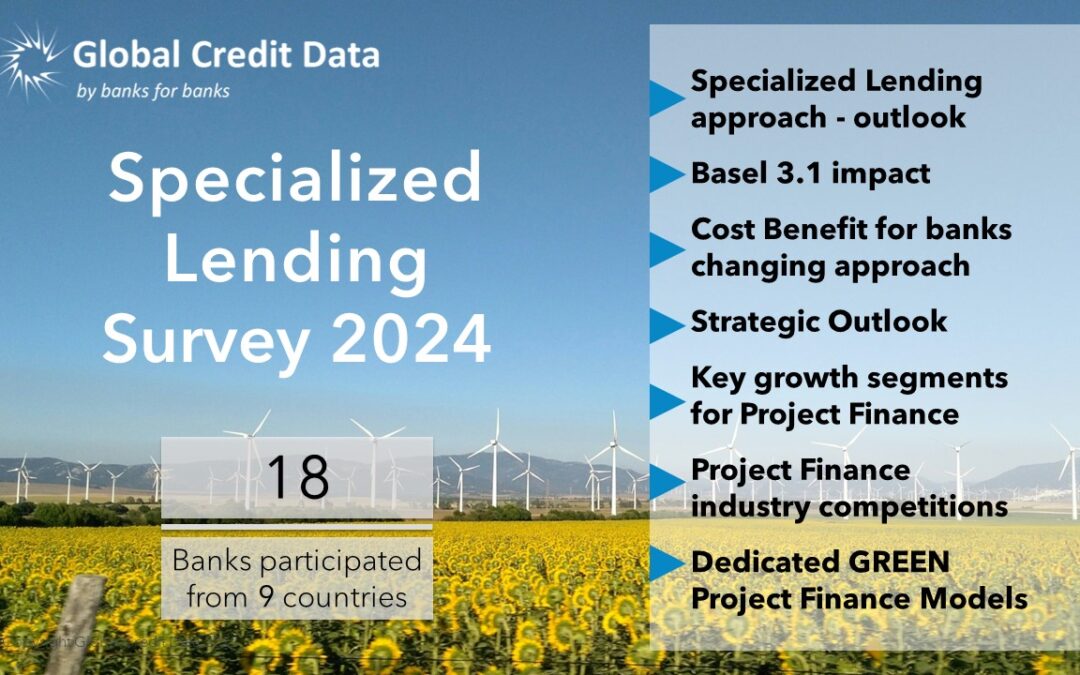

GCD Specialized Lending Survey 2024

Detailed overview of how banks are preparing for the future of Specialized Lending. It covers regulatory actions, portfolio development, and strategic approaches.

Pandemic Aftermath: GCD Data Reveals Decline in US Real Estate Recovery Rates

New Report Highlights Impact of COVID-19 on U.S. Commercial Real Estate

2024 H1 Cycle Data returns released on GCD Platforms!

GCD Platforms Release Comprehensive H1 Cycle Data Returns The latest data returns for the H1 cycles have been released on all GCD platforms. This release provides banks with the most current and comprehensive data for Probability of Default (PD) and Loss Given Default (LGD) modeling, benchmarking, and more! We extend…

News: GCD and UNEP FI Collaboration

GCD and UNEP FI Collaborate to Enhance ESG and Climate Risk Efforts Global Credit Data (GCD) and the United Nations Environment Programme Finance Initiative (UNEP FI) are pleased to announce their partnership. This partnership aims to advance the methodologies and benchmarks used by financial institutions to assess and manage climate…

Press Release: The Global Credit Data Consortium appoints Ramadurai Krishnan as CEO

The Global Credit Data Consortium appoints Ramadurai Krishnan as CEO.

GCD Toronto Spring Conference 2024 Highlights

GCD Toronto Conference 2024 - Credit Risk | ESG | Climate

Climate Focus Group Update March 2024: Climate Stress Testing, Global Events & Regulatory News and more

GCD Climate Risk Focus Group where climate and credit risk measurement come together! Dear GCD Members and Friends, Stay informed with the latest activities in Climate Risk at GCD: Information on upcoming webinars featuring insights on Climate Stress testing from the National Bank of Canada and the latest insights on…

Register now! GCD Toronto Conference 2024 | April 29th

Register Now for Toronto Conference Spring 2024

Announcing the Latest Data Release!

With over 30,000 names spanning across North America, Europe, South Africa, and Australia, banks utilize our Name Benchmarking data pool as a valuable resource for comparing risk parameters with their counterparts in similar regions.

GCD Newsletter – December 2023

Download a copy of the latest GCD Newsletter.

GCD Recovery Rate for Loans with Insurance Guarantors

Global Credit Data and ICC and ITFA Collaboration: Recovery Rate for Loans with Insurance Guarantors

GCD and ICC – 2023 Trade Register Report

In partnership with Global Credit Data, ICC have released the 2023 ICC Trade Register Report.

Impressions from the GCD Amsterdam Conference

Here are some snapshots that capture the essence of the Amsterdam Conference 2023.

GCD Representativeness Focus Group – Join Today!

Join the GCD Climate Risk Focus Group (CRFG) to help shape our approach to climate-related credit risks and become part of a collaborative and knowledge-sharing community for climate experts.

GCD Newsletter – September 2023

Download a copy of the latest GCD Newsletter.

GCD Climate Risk Focus Group – Join Today!

Join the GCD Climate Risk Focus Group (CRFG) to help shape our approach to climate-related credit risks and become part of a collaborative and knowledge-sharing community for climate experts.

GCD Newsletter – July 2023

Download a copy of the latest GCD Newsletter.

News: GCD and UNEP FI Collaboration

GCD and UNEP FI Collaborate to Enhance ESG and Climate Risk Efforts Global Credit Data (GCD) and the United Nations Environment Programme Finance Initiative (UNEP FI) are pleased to announce their partnership. This partnership aims to advance the methodologies and benchmarks used by financial institutions to assess and manage climate…

Climate Focus Group Update March 2024: Climate Stress Testing, Global Events & Regulatory News and more

GCD Climate Risk Focus Group where climate and credit risk measurement come together! Dear GCD Members and Friends, Stay informed with the latest activities in Climate Risk at GCD: Information on upcoming webinars featuring insights on Climate Stress testing from the National Bank of Canada and the latest insights on…

Register now! GCD Toronto Conference 2024 | April 29th

Register Now for Toronto Conference Spring 2024

GCD Recovery Rate for Loans with Insurance Guarantors

Global Credit Data and ICC and ITFA Collaboration: Recovery Rate for Loans with Insurance Guarantors

GCD and ICC – 2023 Trade Register Report

In partnership with Global Credit Data, ICC have released the 2023 ICC Trade Register Report.

Impressions from the GCD Amsterdam Conference

Here are some snapshots that capture the essence of the Amsterdam Conference 2023.

GCD Representativeness Focus Group – Join Today!

Join the GCD Climate Risk Focus Group (CRFG) to help shape our approach to climate-related credit risks and become part of a collaborative and knowledge-sharing community for climate experts.

GCD Climate Risk Focus Group – Join Today!

Join the GCD Climate Risk Focus Group (CRFG) to help shape our approach to climate-related credit risks and become part of a collaborative and knowledge-sharing community for climate experts.

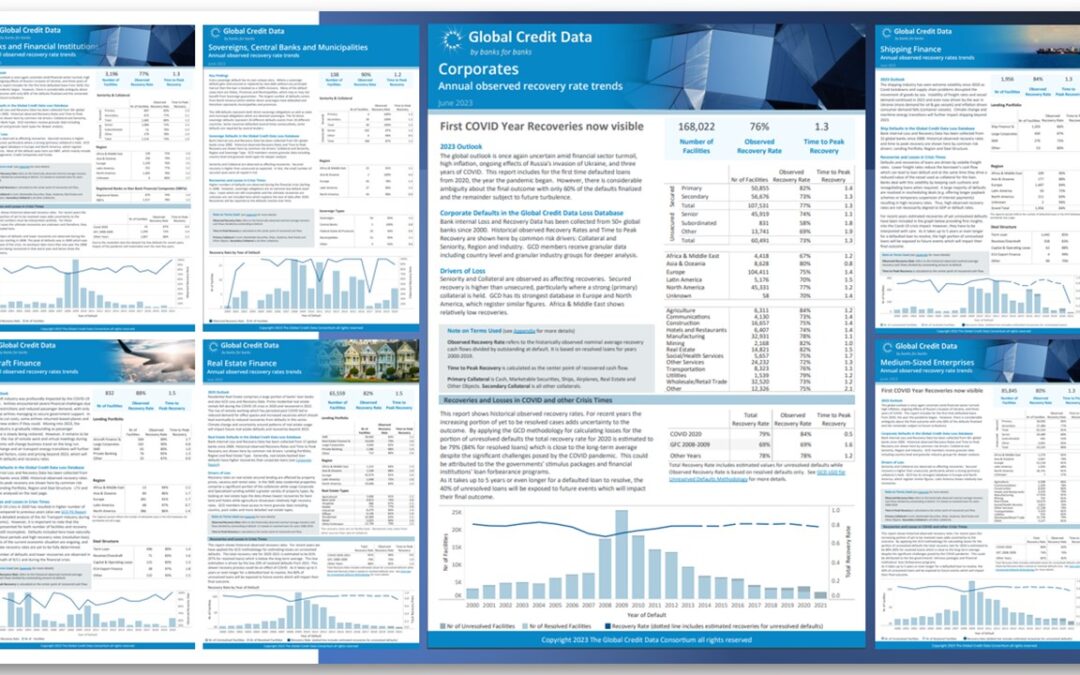

GCD Recovery Rate Reports published!

Global Credit Data's yearly Recovery Rate Reports for Corporates, Banks, Sovereign, Aircraft, Shipping, and Real Estate defaults provide instant insight into observed recovery levels and other key benchmarks for various exposure classes, industry sectors, and collateral types.

GCD Recovery Rate Dashboards

Insight into observed recovery levels and other key benchmarks for various exposure classes, industry sectors and collateral types.

PD Dashboard: Large Corporate Defaults

Macroeconomic trends in 2022, initially marked by expectations of reduced government support for the pandemic, progressive tightening of monetary policies by central banks and rising inflaon rates must now consider market stress, energy cost surge and negative fallouts from the war in Ukraine. Concerns about new Covid-19 variants cannot be ignored neither.

GCD Data Quality 2022

Since 2004, GCD has continuously reinforced a framework that is used to measure and monitor Data Quality (DQ). The objective is to achieve high DQ and compliance for the GCD pooled data, as required by global regulations (BCBS 239, ECB Guide to internal models, Fed SR1107).

Downturn LGD Study 2020

Downturn LGD Study 2020 This Global Credit Data (GCD) study looks into the historical effects of previous downturns on bank credit losses across various debtor types, industries and regions, with a view to helping banks understand not only the high-level impacts of a downturn, but also how credit risk drivers…

LGD models must include unresolved defaults to avoid resolution bias, argues latest GCD study

Latest report from Global Credit Data highlights need for unresolved defaults to be incorporated into modelling process

Capitalising on capitalisation: Can better capitalised banks minimise COVID-19-related losses by leaning on cash reserves? asks GCD study

PRESS RELEASE - October 22, 2020 Latest report from Global Credit Data analyses the impact of economic downturns on loss given default Results show that banks can weather the negative downturn effect by adapting their workout strategies The amount a bank loses on defaulted secured loans depends more on when…

GCD Reports

Global Credit Data maintains the world's highest quality, most exhaustive member-bank contributed data source for credit risk.

Download Global Credit Data publications below for Recovery Rate, LGD and PD Reports. These reports provide an instant insight into observed Recovery Rates and other key benchmarks for various exposure classes, industry sectors and collateral types.

Real Estate

Real Estate - Global Recovery Rates 2024

Real Estate - PD & Default Rates 2024

Corporates

Project Finance, Shipping and Aircraft

Sovereigns, Banks and Non-Bank FIs

More information on the methodology can be found in the Appendix documentation of the reports.

PD Report for Large Corporates Appendix

Recovery Rate Report for Corporates Appendix

Recovery Rate Report for Banks Appendix

Recovery Rate Report for CRE Appendix (2022)